How to Pay Off Debts

As an Amazon Associate I earn from qualifying purchases. For more details, please see our disclosure policy.

Ready to pay off those debts? Well, you might have to bulldog it.

Want to save this post?

Enter your email below and get it sent straight to your inbox. Plus, I'll send you time- and money-saving tips every week!

photo source: Sabianmaggy, used by license

We’ve been talking these last few weeks about getting our finances in better order. Some people naturally know how to do this. Others of us need to learn, sometimes the hard way. Ahem.

We dug ourselves a big hole, and eventually we climbed out, paying off $18,000 in consumer debt in 18 months. It wasn’t easy, but it was worth all the blood, sweat, and tears. We feel free.

Currently, we’re in debt to ourselves. We don’t have consumer debt, but we’ve had to dig into savings to pay extra expenses on the Blue House.

(The rental property we bought ten years ago was originally painted blue. Since it has done nothing but make us feel blue, we figure it’s an apt moniker.)

Anyway, we’re now in the process of building back up that savings the Blue House has eaten up. So, we’re in debt to ourselves.

Whether you owe the bank, a relative, or yourself, it’s always good form to get it together and repay those debts. Here are some ways that you can do it.

1. Stop using credit. Don’t create a bigger hole for you to climb out of.

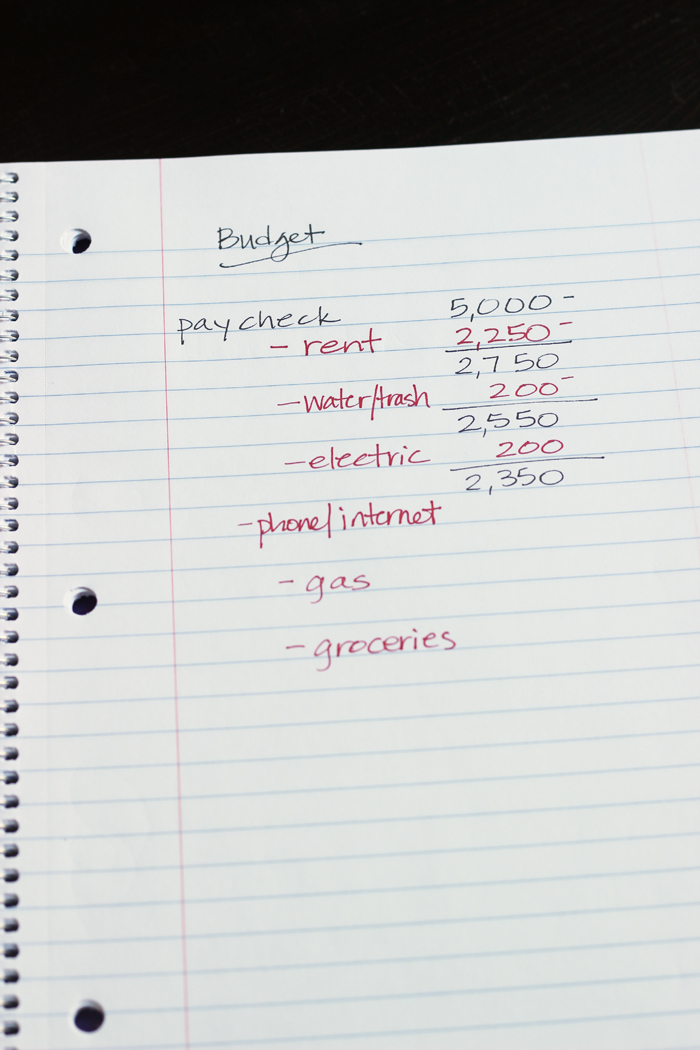

2. Set a budget. Tell your money where to go, instead of it telling you there’s nothing left.

3. Create an emergency fund. Build a cushion for yourself against the unexpected. They will come. Trust me.

4. Live within your means. It’s simple but hard. Don’t spend more than you have.

Next up: Pay down the debt.

You knew I was going to say that, right? It’s better to be beholden to no one. But, it’s hard. There are many temptations involved. There are things that you think you have to have.

(Hint: your probably don’t.)

So today, I’m going to play the bossy big sister. Ask my two brother and two sisters: I play this role well. Listen well, little grasshopper.

How to pay off debts:

If you’ve followed the steps above, you should be able to pay for living expenses. But you’re going to need to get a little bulldog in order to pay off your liabilities.

I don’t mean you should go buy a dog. I mean you should act like a determined little bulldog who won’t let go of the bone until it’s his. You are going to be a bulldog.

1. Pay off the little debts first.

Dave Ramsey recommends that you line up all your debts and pay off the smallest ones first. There’s all kinds of debate about this. Some folks say you should pay off the highest interest rate. That’s what FishPapa said at first, too. But, Dave somehow convinced him to do it this way.

Paying off the little debts built confidence in us that we could accomplish great things. It also simplified things as we were basically picking off the easy targets so we could take on the bigger enemy Doberman Pinschers.

You’re a bulldog, right? Throw any extra money you receive at your debt each month.

2. Sell some stuff.

We realized that there was plenty of stuff that someone else could want — and be willing to pay for — that we didn’t really need. We had garage sales and sold stuff on eBay and Craigslist. Crystal helped me have my one and only EXTREMELY SUCCESSFUL garage sale, so follow her tips, for sure.

For us, financial stability was more important than a bunch of piddly stuff.

3. Find ways to increase your income.

I’m not sure I would be a professional writer if our income had been higher. I might have done it for fun, but I wouldn’t have been as motivated to restart my career if we hadn’t had financial needs. I started out writing articles for parenting magazines, at first, and then moved on to blogging and cookbook writing.

If you need more income, find out ways that you can drum that up. As the holidays approach, consider taking a seasonal job. There are lots of ways to work from home or make an extra income.

4. Put off extras.

This is probably the hardest part to getting out debt: delayed gratification. We’ve had a hard day; we want to drown our sorrows in a Salted Caramel Mocha Frap. We deserve it.

But, that puts you another $4 away from your financial goal. Be willing to defer luxuries in order to get the price. Be willing to do without.

5. Be brave.

Paying off debt can be a long, hard process, full of fits and starts. I remember sitting in a park one day with a friend who had managed to stay out of debt through her husband’s law school. I clearly remember her encouragement; though I don’t remember the words. It gave me the courage to keep on even though it was hard and using the credit card was enticing.

You can do this. You just need to have courage.

Have YOU paid off your debts?

What helped you? What’s stopping you? Let’s chat in the comments.

Hi Jessica. We have only had college debt and mortgage debt. It was $38,000 of college debt and about 5 years back we decided to tackle it. We paid off $16,000 in 16 months. It was TOTALLY addicting! I saved up every dollar from piano lesson money I could, and would pay to our debt weekly sometimes, it was so addicting (in a good way). Blessings on getting yourself paid back. I love that mentality! I can’t take my piano lesson money until I teach a lesson because I haven’t earned it yet, even if people pay me. Have a great weekend!

This is excellent advice. Yes, we paid off a huge amount of consumer debt and got rid of all car payments. All that is left is the mortgage. It was so hard, but definitely worth it. Hubs worked extra jobs, we moved in with his parents for a short time, and we purchased only the most basic needs. It is difficult to learn to say no (to everything!), but the peace of being debt-free is worth temporary discomfort. I agree with you that paying off the smaller debt is more effective, not from a financial standpoint, but from a mental standpoint. As soon as you realize the debt can disappear quickly, it really does encourage you to keep going. One thing that really helps is looking at how much interest you are spending in a year. That’s a real motivator! Thanks for the post.

I so needed to hear this today. Thank you.

And now after reading Amy’s comment, I realize I’m in a pretty good spot and need to just put on my big girl panties and handle what needs to be done. 🙂

I am currently still paying off bills. My husband was in a motorcycle accident a year ago and he racked up doctor bills, and ambulance ride, and a 5 day stay in the hospital. I had foot surgery this past February and not al was covered under our insurance. So I called these people and tried setting something up. Some companies were nice and are letting us pay what we can, other are a stickler and want what they want. But I have been able to put 10.00 a week on these bills. He was laid off for 5 months and that put us in a pickle too. I had a savings for two months which is the norm for his job. Well that turned into 5 months and going from a budget of 3600 to 1400 hurts really bad. But I am still talking to some of our bill people and they also are willing to work with us cause even though it’s not a lot of money, they still see we are trying to pay off our debts. So my advice even if it’s only 5 dollars a month keep sending it because they rather get a little than not at all.

((((Amy)))) Just felt like I needed to give you a hug. My family has been in tough financial situations before and it is not fun. I hope things get better for you.

Hang in there! You WILL make it through.

Ugh sorry blue house continues to be such a drain!

We’ve all got those albatrosses though – I expect to hear we need a check for our money pit sometime soon

We have paid off all but our mortgage – the most important thing for me was a zero based budget and tracking every dime – then excess could go to payoff!

I didn’t tell you guys that there was a sale pending. And then this weekend, the buyer got cold feet. This might just do me in. Pray that we can sell this.