You Can Get Out of Debt

As an Amazon Associate I earn from qualifying purchases. For more details, please see our disclosure policy.

Want to save this post?

Enter your email below and get it sent straight to your inbox. Plus, I'll send you time- and money-saving tips every week!

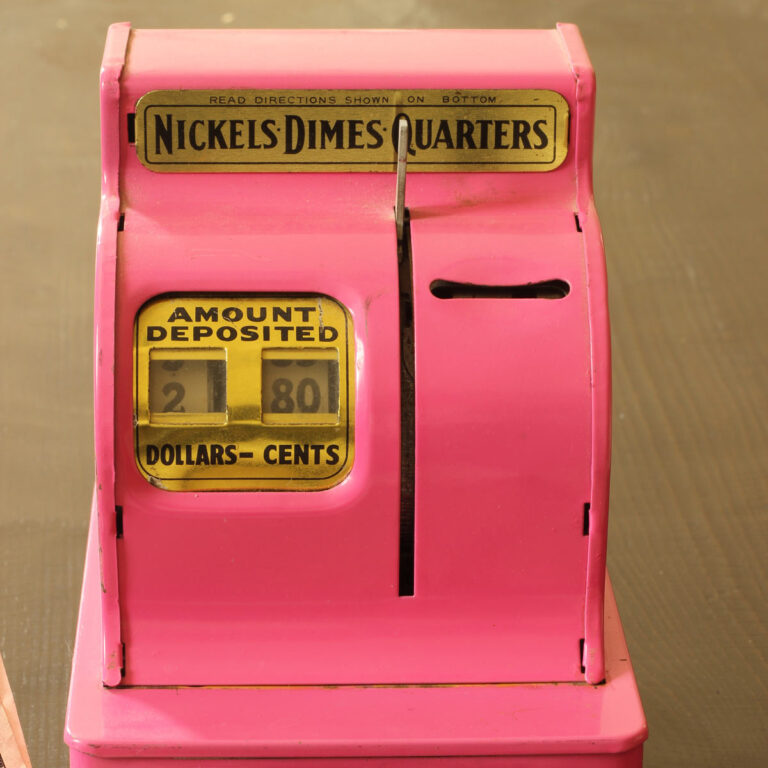

Photo credit: Daniel Oines by license

As a college freshman, I was able to get a credit card in about five minutes. How ironic that ten years earlier, my mom, a college instructor with a Master’s Degree, couldn’t get one because she didn’t have a full-time job.

What a switch that a bank was willing to give me a line of credit, uneducated and unemployed, when only a decade before my mom couldn’t even write a check — for money she had in the bank — without two forms of ID, one of which needed to be a credit card for which she wasn’t eligible.

Times have changed. And I wish I had never seen that credit card booth with its free water bottle and a few coupons for fast food.

Oh, I was responsible enough. I paid it off every month. I didn’t buy frivolous things. But, it eventually became the source of much stress and heart ache. We lived to tell the tale of getting OUT of debt, but it was hard work.

Back in the old days, I often told myself that I should pay it off. I should get out of debt. It was a should but not really a must. Or even a can.

Should you get out of debt?

I hear people say this all the time: “We should really pay that off.” But their hearts aren’t always in it.

Let’s think about it differently: Must you get out of debt? You might be in that position and know it already. That is half the battle. Decided to fight the good fight, however hard, is a great step in the right direction.

Lest someone feel like I’m bossing them or guilt-tripping them about their spending habits, let me rephrase again.

You CAN get out of debt.

Yes, yes, you can. I don’t need to convince everyone. Many of you already now that you should, must, and can. And you’re doing what it takes to make it happen.

But, some of you make a lot more than the rest of us. Some of you are carrying balances you don’t need to carry. Some of you really can get out of debt, and I want you to think about doing it. You can do it.

(Please hear my empowerment voice, not my nagging, guilt-tripping voice.)

If you are in debt and you have the means to get out, I want to encourage you to do it.

By means I am referring to the fact that you have “an income to sufficiently pay for your basic needs with a bit extra to pay down debts instead of buying stuff you really don’t need.”

Here’s why:

1. You will have a freedom you never knew existed. You will feel less stressed because you will be beholding to no one. It’s a really good feeling not to owe money to someone else. It makes you truly independent.

2. You will be ready for an emergency. I’m not thinking that the economy is so stable that it can’t dip back again. I hear over and over about higher prices and lower take-home pay. Position yourself so that you can ride out tough times. Save for a rainy day. You have the means to do it today; you don’t know what tomorrow holds.

3. You will enjoy your adventures more. Dinners out, new clothes, vacations: when you do spend money, it will be more fun because it’s paid for.

Yes, it’s weird to live debt-free, but it’s good. It’s not easy, but it’s good. And you CAN do it.

Are you game?

Related: If you want to get started, check out these 8 Ways to Get Out of Debt. We’ll be discussing them more over the weeks to come.

Also related: I know some of you are already working really hard to pay off your debts. I know you don’t need convincing. Keep on trucking.

This is Frugal Friday. In an effort to make these weekly financial discussions more interactive, I’m no longer posting a link-up. Feel free to leave a link in the comments. But better yet, chat with us on today’s topic.

Just paid off my van last week. Now debt free except the mortgage, and you are right…. so freeing. Makes me feel like I can actually be ready for an emergency, job less, whatever might come our way! Hopefully not, but it def. makes you worry less!!!

Go YOU! Yay on paying off the van!

My husband and I worked extremely hard to get out of our huge credit card debt and vow to never return there. We only have our mortgage left. We would like to pay that off as soon as possible, but with this economy, it has been quite a challenge. I cannot tell you how much less stressed we are having all of that debt off of our shoulders. I think it is great that you are trying to encourage others to do the same. Great reminder for those of us who have been there, as well.

While I have no consumer debt ( and luckily never really have!), I LOVE these reminder posts! I need them! They keep me out of debt! We are in the middle of selling our house to move to be closer to my husband’s work (reduce a 70 minute each way commute to 20 minutes each way). This post made me re-evaluate my reasons for wanting to move. It’s not to get a bigger, better house, but to increase our family time, to be more intentional with our time. But most importantly, this post made me stop and think about that. My reasons could have been bigger and better, and unless I stop and think and re-evaluate my reasons, I won’t stay out of money trouble! And as we are starting the house hunt for our new home, this reminds me of that, the reasons we want to move, and hopefully will help us focus on that, and not get sidetracked by the bigger and betters out there. Thanks for the reminder !

It is, indeed, a very slippery slope into debt. So great that you feel good about your priorities as you proceed with your move!

I was always taught that spending money on what I need or what I want, is two totally different things.

My wage is selling hours of my life for money. When I use that money to buy things I like or think are cool, I am spending hours of my life to obtain THINGS.

This mindset is very different from my friends who often comment about my dress for a function is the same, but complain they can’t go to Germany for a month like I do. It is all about what I really want to spend the “hours of my life on.

I got pretty deep into debt with my ex-husband but after leaving him determined that I hated, HATED debt and didn’t want anything to do with it. My best advice for anyone struggling with debt is to read books and blogs about financial management. You’ll be exposed to an entirely different outlook when it comes to money and spending and you’ll eventually find yourself questioning your own spending habits. When that happens, there’s nowhere to go but up. Good financial management is truly an entirely different mindset from spendy-spendy habits. Luckily, you can teach yourself simply by exposure.

A few of my favorite blogs: Mr Money Mustache (potty mouth, but truly a mind altering perspective on how to deal with your money) and The Simple Dollar (I don’t always agree with some of his more specific financial advice, but he also has an excellent outlook on money and spending. And not a potty mouth.)

Thanks for the references. It can be so encouraging to find the right fit for you in terms of personal finance coaches. It helps when it feels they are inspiring you.