Why I Want to Live Debt-Free (& What’s in it for YOU)

As an Amazon Associate I earn from qualifying purchases. For more details, please see our disclosure policy.

To live debt-free is not as impossible as it might sound. I was once a skeptic, but now I’m a believer that we can live within our means. Here’s why I think it’s a valid pursuit.

Want to save this post?

Enter your email below and get it sent straight to your inbox. Plus, I'll send you time- and money-saving tips every week!

Almost eleven years ago my husband and I were convicted to stop using credit and to pay off our debts. Thanks to God, Dave Ramsey, and some hard work, we were able to do just that.

Nowadays we don’t spend money we don’t have and except for a mortgage on a rental property, we have no debts. I’ve told our “get out of debt” story before and shared how we did it.

Today I want to share the WHY behind all that effort.

Why I Want to Live Debt-Free

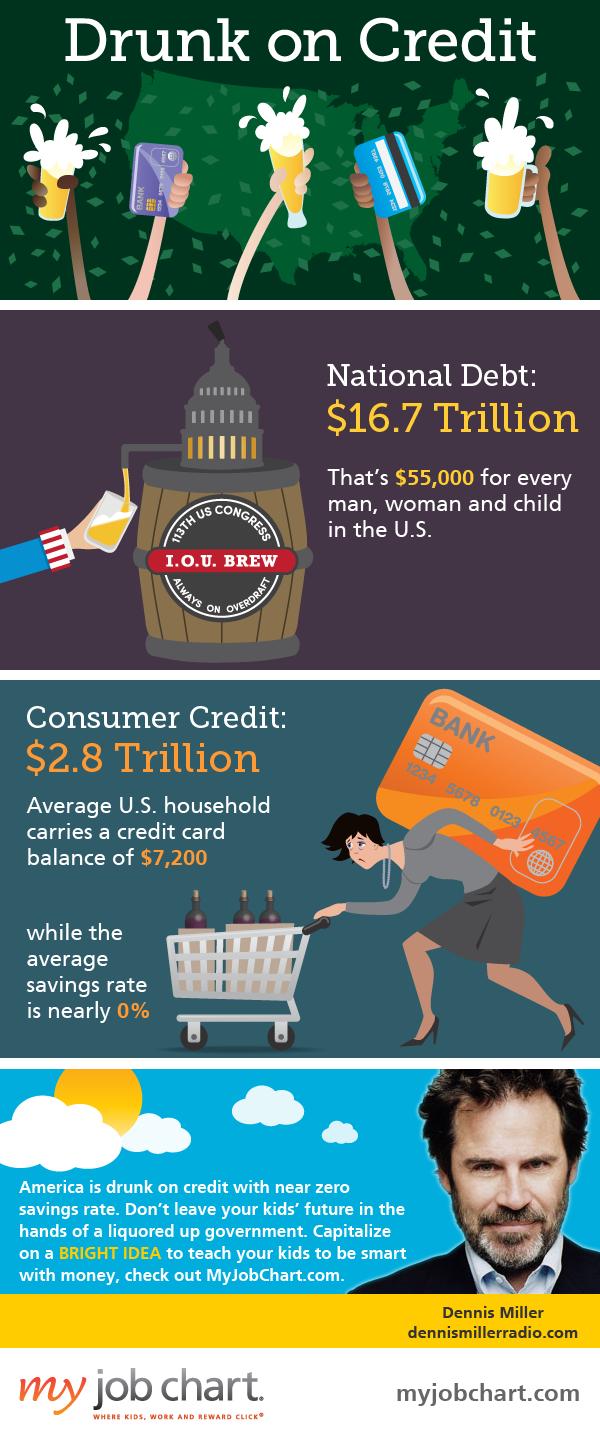

What’s the big deal? Why should we live a debt-free life? Isn’t the American Way, life, liberty and the pursuit of more stuff? Isn’t a mortgage and a couple car loans a rite of passage? Isn’t plastic the only way?

No, ma’am. I beg to differ.

Now, before you get all antsy at me, let me tell you that I was once a MAJOR, BIG-TIME skeptic about this debt-free living stuff.

Sure, I’d heard about people being “convicted to live debt-free,” but I figured that it was just unnecessary. Credit was a resource that God had given us to get by in this world. Hmmm…. and HA! I don’t think so.

Here are a few of the reasons why me and my house prefer to live debt-free.

Our expenses are lower.

Since we do not have car payments, school loans, or credit cards to pay each month, the money on the paycheck is ours to spend. Obviously we have rent and utilities to pay for, but overall our expenses are lower and we get to decide where our money goes.

We’ve been able to create so much wiggle room in our budget, that we’ve been able to take our family of 8 on month-long trips to Europe. TWICE. Reason enough? Yes’m.

We aren’t “behind.”

We belonged to the school of thought that said credit cards were okay as long as you “paid if off each month”.

Well, that is still debt! We were always a month behind. Instead of the paycheck going toward’s tomorrow, it was paying for yesterday. I’d rather pay it forward than backward.

We aren’t slaves to debt.

The Bible says that the borrower is slave to the lender. And it’s true. When we had debts, we were obligated to someone else. Today we’re responsible to ourselves.

We aren’t living speculatively.

Some of the reasons that our country has been in a mess financially is due to speculative behavior, spending money that you don’t have on something that may or may not increase in value in the future.

Using credit, in my experience, was risky. Sure, we might make it big, or as it turned out, we might be unemployed for a time and be stuck in major debt with two houses we couldn’t sell in a down economy.

I prefer to spend what I have rather than hope for “something” to pan out.

The view is better when you’re not in the hole.

Life can feel pretty depressing when you’re in debt and your money — and your life — are not your own. It’s amazing how different it feels not to have financial obligations.

When I filled out our rental application for this home, there was no longer a list of creditors to claim! We have more freedom than before and it feels different.

Most importantly…

We rely on God instead credit.

When we used credit cards, we knew we had a back-up. We felt this false sense of security that if we couldn’t make the ends of each paycheck meet, well, we could carry over to the next month by letting a little balance ride.

Now that we don’t rely on Visa, Mastercard or American Distress, we rely on God.

And who better to rely on? Who can calm a raging storm? Who can feed the multitudes with a young boy’s lunch? Who knows what we need before we need it? He does.

Paying off debt was one of the hardest, yet one of the most fulfilling things my husband and I have ever done. I realize that for some it sounds ridiculous. Wouldn’t be the first time I did something strange.

For others it seems impossible. But, I think you’d be amazed at how do-able it can be. Curious? Head here.

Do you live Debt-free?

Originally published January 19, 2010. Updated March 17, 2018.

Wow, talk about good timing. I just started the process of trying to get out of debt yesterday. Its going to be a long journey but i know it will be worth it. Im in your kitchen survival workshop and now i want the “not your mamas freezer cookbook” but its not in the budget anymore. First time in my life using a budget. Im excited and want to teach the kids good money habits now.

You are making one of the best decisions ever. Now that we’ve got two in college, God has worked the details that we’re even able to get them through college debt-free. They’re doing a lot of the work (working jobs, taking the train, packing lunch), but it’s so great to think that they WON’T have a 100K in school debt when they’re done.

I am debt free, except for my mortgage. I am planning on paying off the mortgage in the next few months (paid off a 30 year mortgage in 15 years).

Great job!

Great post over at Erin’s site — I love how you “beg to differ” about feeding your family for less! Loved this post as well. I especially liked how you describe using credit cards on #2. We used to use a card that we “always paid off”, but it just felt different when we stopped altogether and started using cash or debit. Using a card almost felt like hedging your bets against something happening leading you to want more money available in your checking, instead of doing the responsible thing and bulking up an emergency fund instead.

I passed along a award, if your interested in taking part in.

It took me and the hubby several years to get debt free, except for the car and our house and MILs house. No one would ever imagine having to use their life savings because their 4-year old was the victim of a horrible crime, but that is my story. Had we not been debt free I don’t know how we would have fought to protect our daughter and get her the medical help she needed that wasn’t covered by insurance. This was going to be part of our retirement, and I know we shouldn’t have gone there but I’d rather be poor later in life knowing I put a predator behind bars and did everything possible to give my 4-year old the opportunity to have a life not marked by the word ‘victim’. This was more than an emergency, but being debt free and living frugally gave me the peace to know that I can fight. No one can ever anticipate being a victim of a crime, and I would NEVER want anyone to have this experience. But being debt free allowed me to quit everything and just focus on healing my daughter and our family.

I love stories of God’s provision as we throw off the chains of bondage to debt! Thanks for the encouragement 🙂 We spent a year living in our friends’ basement so we could pay off some some of our student loan debt and save up for a down payment on our first place. I know it wasn’t exactly the way Dave Ramsey would suggest, but for our new location and with my husband working from home, our house costs us about the same as renting a decent townhouse.

We are really excited about paying off even more student loan debt this year with some hard work and provision from the Lord!

Love reading the success stories of those who have done it! Thanks for sharing. My husband and I are a few years away from this goal (WAY too much student loan debt), but we are working on it. One of the ways I am trying to help is by couponing and lowering our grocery budget. And, I’ve committed to making beans and rice every day this year! Check out my ideas: http://www.pameladonnis.com/cooking.

I’m with you! Good work. We look forward to the day we are living debt free. We’re still working the plan and each year we see a difference. Now, we expect to see results every month (with our new budget). I’m so excited to be able to buy those bigger ticket items for cash (shingle the roof in 2011, computer, truck repairs, new bed), etc etc. Usually we just use debt to get these things because we believe we ‘need’ them.

No we don’t. We can wait.

My reasons for wanting to live debt free are the same as yours. We honor God by managing well what he gives us and our finances (when freed up and available) can be used for his purposes.

So very excited to watch it happen.

Thanks for sharing your journey with that 😉

God has been gracious to allow my husband and I to be debt free for most of our marriage! We paid off both of our cars shortly after we got married, and aside from a mortgage payment, have not had any debt since then! We were excited to be able to buy an almost new vehicle recently for CASH! How great to have something so reliable and necessary for our family without having to make payments (of course, we are “making our payments” to our savings account in order to be able to pay cash for our next vehicle, too).

It’s great to hear about so many other wives/moms who are committed to being wise with their finances!

The Domestic Contessa blog: 15-Minute Tackle: Weekly Link-up + Giveaway!

I’ve been writing about this subject on my blog lately too. But I like yours better. We’ve been trying to convince a lot of people that debt is a stupid idea by looking at the numbers and they keep arguing with us. Looking at it primarily from faith is a better idea. I don’t know that it would stop the arguing, but I feel like it should. 🙂

God has been gracious and allowed my husband and I to be debt-free for much of our married life (apart from the house mortgage)! We recently sold our house and are in transition in a rental, waiting to be able to move across the country so that my husband can go back to school. It’s been so encouraging finding so many blogs out there with wives/moms who are commited to using their money wisely!

I’m excited to say that we were recently able to buy a newer SUV with CASH! It’s so wonderful not to have any car payments to make each month (though we are putting aside our “car payment” into savings in order to be able to buy our next vehicle with cash, too!).

The Domestic Contessa’s latest post: 15-minute Tackle: Weekly link-up + Giveaway!

Oh, I can’t wait!!! We are not debt-free but we are headed there!!

We are so excited that the remainder of our debt should be paid off in less than a month!! The only thing remaining will be our house (soon to be rent house, since we’re moving overseas)! But, we’ve decided to keep the house indefinitely since we’ll be able to pay it off in roughly 10 years (haven’t run the exact numbers on that yet), then we will ALWAYS have a home, no matter what the economy is like.

It feels so good to know that in one month, we’ll be able to breathe freely and all that money that has been going to debt each month will be OURS!

Amen!

We’re not quite debt free yet, but we’re getting closer. This journey of undoing out past mistakes has absolutely limited our choices for the last few years, and I’m kind of glad it did. It has been like being a child in time out. We made mistakes. We have to pay for them with sweat and ‘sitting this one out’ over and again until everything is taken care of. We aren’t there yet, but I solidly believe the first step was the hardest, most amazing thing we ever did. I can’t wait to join the rest of you in the ‘freedom club’.

Ah, I know exactly what you mean – times two! I came into our marriage with no debt and spent the next 2 years of my life paying off my husband’s. But then we took out a student loan and a car loan. then we spent three years paying those off. It was so wonderful to be debt free (except the home). We were able to do so much in that time. We even saved cash to pay for a new to us car for dh.

Well then just a year later we needed to replace our van. We saved like crazy, but by the time we had to replace it we only had $10,000. We bought a new van and took out a large loan. We thought it would be fine. On paper it should be. but you know how life goes. I figured we would have it paid off in a year, that was the plan. Speculating on the future I guess. Fast forward 6 months and my husband’s work almost went on a strike, numerous plumbing issues, car repairs, replacing the well pump, you name it and it has happened. If we didn’t have a $400 a month car loan we would be able to cash flow this stuff. Instead we are stressed to the max trying once again to make ends meet. Ugh, never again. Reliving being in debt has taught me again exactly why debt is bad and why I don’t want any.

My husband and I have just begun our journey to being debt free. We are currently attending Ramsey’s Financial Peace University and have already started to make a little headway in paying off our debt.

I think our biggest obstacle to being debt-free is lack of self-discipline and lack of the ability to tell ourselves “no’ when we think we need something. It’s something we are definitely learning about ourselves and trying to work on together. Thanks for your encouragement!

You are so good! I would love to get our debt paid off once and for all. It isn’t a lot and it was for necessary expenses, like a washer, dryer, and refrigerator, but it would be nice to get rid of it and start fresh so we can save more. We keep trying, but it seems something else always comes up.

great post. we’re working towards being debt free right now and i’m going to slowly share our story on my blog.

Like you, we used to pay our credit card off each month. When we decided to stop the insanity it took about 3 months to become debt free. I thought we weren’t in debt b/c we paid it off each month. But, when all of the sudden you had $4K on your bill and have to pay for the coming month we didn’t have that amount to pay it off and it took three months throwing the extra at it to stop the cycle.

We committed this year to pay off our last debt, our student loans, and I decided to track my progress on a new blog. We’re only nearly 3 weeks into the year and it has been so crazy seeing the places that Heavenly Father brings money from (like the Tylenol I almost delivered to a Haiti relief site but got there too late, and then the recall was issued the next day). Seriously, I’d think I was being stalked by someone if I didn’t know how aware He is of His children’s needs, ha!

Amen! We too are debt free except for the house. We are hoping and planning to pay it off in the next 7 years instead of 15. Being debt free allows you to give right when a need arises. For us, it has meant being able to go on Mission Trips. We can afford the airfare etc. when we aren’t worried about bills. Its a very “free-ing” state of living!

And the borrower is slave to the lender! We also have taught FPU, for adults at our church and I did it for the teenagers in our homeschool group.

Dave Ramsey has great advice that really works. But it is work and you just have to change your own attitudes toward debt, money & budgeting.

I just finished reading through all the posts that linked to you getting out of debt. I too find it hard to think of % when it comes to budgeting and I always found it to be overwhelming or discouraging if I didn’t fit into “said author’s” recommended % for a category.

This has given me hope and a vision. I am familiar with Dave Ramesy. I will be getting the book today from the library.

Thanks!!!! : )

Right on, sister!! We are also debt-free except the mortgage. We teach Dave Ramsey’s FPU at our church and have graduated well over 100 families in the last couple of years. What a blessing it is to be living without debt!

Oh, I forgot! Since we live debt free I am able to stay at home with our kids and work only part time for personal fulfilliment (I am a freelance musician and work evenings and weekends sporatically). This has blessed us in many ways for which I am ever so grateful.

I learned the hard way about credit cards in my twenties when I was still single. Thankfully I got a clue around the time my professional life picked up so I was able to pay off $8K worth of credit card debt in a year and a half. Never again will I go back there.

What we don’t realize is how much debt traps you. My turning point was when I realized how many of my life decisions were influenced by my debt, how I had to work jobs I hated while still going to school so my studies suffered, having to ask my parents for money to fix my car, etc.. Even now that my husband and I live debt free except for our house the mortgage hanging over our heads has affected some of the decisions we’ve made in terms of both our careers. Our committment to paying off our mortgage early keeps us in check because it’s important to have that debt gone in time for kids to start college.

Although I do think there is such a thing as “good” debt. Judicious use of students loans allowed both my husband and I to invest in ourselves which yielded very satisfying, and in his case well paying, careers in our fields. I had a course of study that is not compatable with working your way through school and I don’t regret the small amount of debt I incurred during my education.

Beautiful my friend. We believe the same way. We haven’t had car payments for at least 8 years and our credit cards are mainly used for purchases on the internet and paid each month. We are in the process of selling our house for the main purpose to be debt free. We have a TON of equity in our house and would be able to pay cash for another one. And then we would have no debt whatsoever. It’s hard to be patient when you feel you are trying to do the right thing but nothing is happening. But we are just relying on His timing and not ours. He knows our hearts.

Keep up the good work and keep spreading your knowledge and heart!

Hugs

Kim