How to Prepare for a Recession or Other Tough Economic Times

As an Amazon Associate I earn from qualifying purchases. For more details, please see our disclosure policy.

Can you weather tough economic times? Wondering how to prepare for a recession? Follow these strategies to set up your finances and your family for success.

Want to save this post?

Enter your email below and get it sent straight to your inbox. Plus, I'll send you time- and money-saving tips every week!

Remember 2009 when folks were losing their jobs, their homes, their retirement? It was a pretty scary time and it took awhile for a lot of people to bounce back.

Here we are ten years later, and there’s talk of it all happening again.

Here’s the thing: Recession is inevitable. The experts all say it’s not a matter of if, but when. Economic downturns are cyclical, and honestly, nothing to be afraid of.

If you’re prepared.

And yes, there are lots of things you can do to be prepared, no matter how well or how bad the economy is doing. Preparing for a recession is no different than preparing for any other emergency. No, you don’t want it to happen and you sure hope it doesn’t…

But you still put on your seat belt when you get in the car.

Getting your finances in order is much akin to putting on your seat belt. Chances are you won’t get in a wreck, but you’ve maximized your potential for survival because you prepared for that emergency.

So what does it look like to put on your financial seat belt?

How to Prepare for a Recession or Other Tough Economic Times

Here are some suggestions in how you can prepare yourself for tough times:

1. Scrape together an emergency fund.

An emergency fund is monies set aside for a true emergency, such as a job loss, an inability to work due to health issues, or a medical emergency.

An emergency is not a new pair of shoes — unless every pair you own is threadbare. It is not a new sofa; you can sit on the floor if you don’t have one. It is not a trip to the movie theater; you can get movies for free at the library.

Your emergency fund is there when nothing else is. It is there to provide for your basic needs (shelter and food) should you get laid off, not get paid, or otherwise be without an income to support you and your family.

The amount you should save toward this type of emergency will vary depending on several factors:

- how many people you are supporting

- how easy it will be to get another job

- the state of the economy

- where you live and how easily you can move

Most experts recommend socking away three to six month’s worth of expenses. This is not six month’s of a luxury lifestyle, but the bare minimum you would need to pay your bills should your income disappear.

That number may appear daunting, but don’t despair. Any bit you can save will help you down the line, so start building that emergency fund now.

Pro tip: Make your emergency fund hard to get to. You don’t want to be tempted to spend that money. It may be helpful to establish that in an account in a different bank than you normally use or an online bank that takes several days to transfer money from.

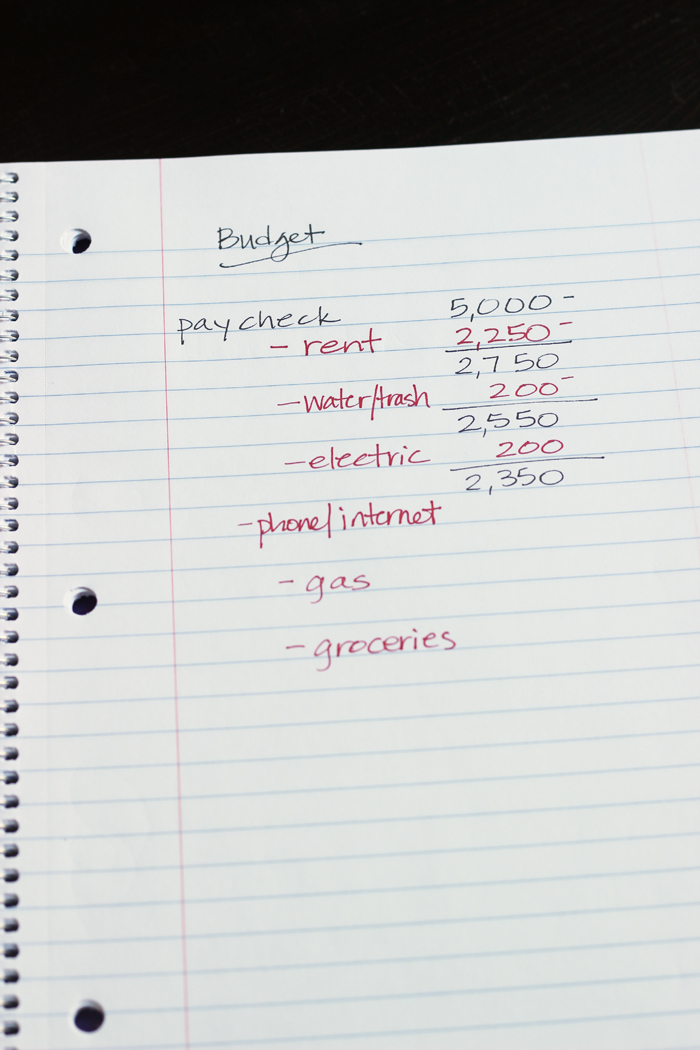

2. Audit your expenses.

It’s pretty easy to overspend. Part of our human nature is to use all the space we have, including wiggle room in the budget.

Be clear on your wants and needs. This is a very good conversation to have as a family. Your kids will learn what they live, with you. Set them up for financial success by being open about how you spend money and how you prioritize your budget.

Look over how you’ve been spending your money and figure out what you can cut. Maybe you don’t need to cut it today, but you do need to know what you could cut.

This is important. In the event of an “emergency,” you will need to start cutting. Make some decisions now while you’re rational and not freaking out.

If you don’t already have one, set a budget so that you’re in a good habit of sticking to your spending goal. For bonus points, go a little tighter in order to hone your frugal chops and build that emergency fund.

Your grocery spending is a great way to practice trimming back as food costs are one of the most flexible line items in your budget. Audit your grocery spending so that you know where and how to cut back.

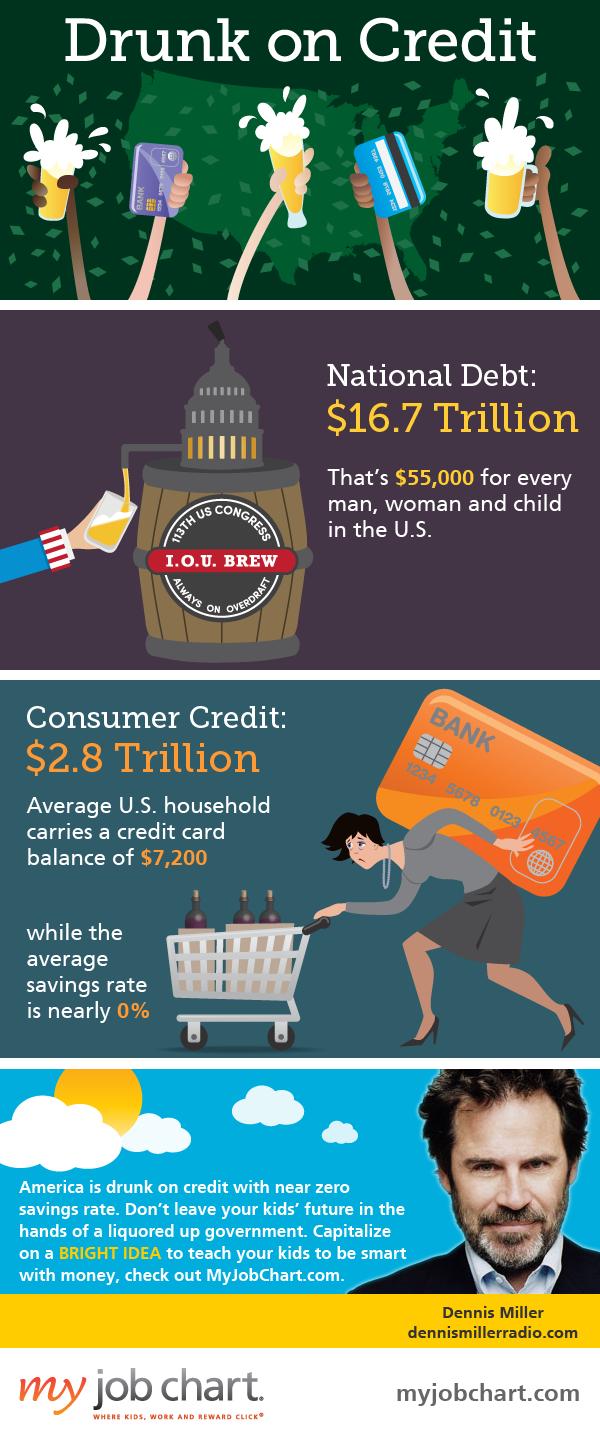

3. Stop spending money you don’t have.

If everyone, from politicians to paupers, would heed those words, the world would be a much better place. We live in a culture that echoes the cries of Veruca Salt,

I want what I want and I want it NOW.

In pursuit of the things that we want now, we borrow from the future instead of saving for it. Unfortunately, math doesn’t work that way. Building up debt is a recipe for disaster and heartache.

Yes, you can live without credit cards.

Stop the cycle now. Don’t spend money you don’t have. Cut up the credit cards. Resist taking another loan. Don’t get fleeced with a lease.

Again, a great thing to discuss with and model to your kids!

Live in today — and spend only today’s money. You can live within your means and still live a good life. Teach your children to do the same.

4. Pay off your debts.

I know from personal experience how debilitating debt can be. It crept up on us slowly, and when we realized our mistake, we were already sunk.

We hit rock bottom at the beginning of the last economic decline. In 2007 we were out of cash and deep in debt. And we didn’t see it coming. We didn’t prepare, because, well, maybe we didn’t think it could happen to us.

You may think that you’re immune to hard times, just like that guy who didn’t put on his seatbelt before the crash.

Debt will hold you back from success, from freedom, from opportunity. And it will make economic hard times even harder because you’ll still be responsible for that debt. Prepare for a recession by getting out of debt.

Getting out of debt was really, really hard for us, but we got out of debt, paying off $18,000 in 18 months — all while having a sixth baby, living on one income, and moving across country. If us poor saps can do it, so can you!

Today, we’ve built up savings and retirement, funded replacement vehicles, sent our kids to college, and traveled to Europe — all debt free. And it feels amazing! The emotional feeling of going from debt to debt-free is an amazing one. Similar to having birthed a baby after a long labor.

Except that there are no afterpains and no big medical bills. Praise the Lord.

Whatever you can do to get your finances in order will only serve you in the months and years to come. Preparing for a recession will help you rest easier should tougher economic times come your way but also set you up for more fun during good times.

We graduated from FPU in November 2017, just two days before we found out my husband was going to lose his job. We have since become debt-free and hubby has a new job. We have our emergency fund fully funded and have a good start in retirement. We are super excited that we will pay off our mortgage in the next three years at <45 years of age.

Good for you, Brenda!

I wrote a post about this same subject recently – http://myoverflowingcup.com/3-things-we-wish-we-had-done-when-we-had-more-money/

I write about the things we wish we had done before our finances took a turn for the worst. In looking back, we wish we had been prepared for the fact that our situations do change. We often live as though life will always be as it is now. It is only later that we look back and regret our choices.

My advice is similar to yours: save money, live simply, and pay down debt with as much fervor as possible.

Thanks for the continued encouragement, Jessica!

YOU are not in spam!

how did you meet Dave Ramsey?

I went on a tour of his offices in 2010 when I was in Nashville. It’s open to the public.

Thanks we need to not go in debt but I am a spender. I have 2 cards in my name so I can have a credit. I feel bad but it was nessary.

We now have to tighten our belts this 2015 with having to buy another car.

im slowly working on our emergency fund…our budget is pretty tight but any money I make selling items, doing surveys, saving change and selling aluminum cans goes into our savings account

Great job! Fight the good fight!

I love cheap entertainment for my son. We made homemade sidewalk paint this week, it was soooo fun!

Refi.ed for lower mortgage and paid off CCs with cash back from the deal. Since then we’re keeping our purchases in check to keep the CCs at bay!

We have been saving a ‘year supply’ of money knowing that my husband’s salary will end come January.

We’re working hard to pay off credit card bills after a financially desperate winter season. Thanks for the opportunity!

Right now my husband and I have been building up our emergency fund/savings and working on paying off some debt. Some days when we have emergencies, like getting the car fixed, it seems very discouraging, but I know it will be worth it in the end. I am so excited about this give a way, I have been wanting to read this book. Thanks!!

We did the fully-funded emergency fund first so I sleep better at night…now we’re attacking my student loans, then his, then FREEDOM!!!

😀

We are working on the emergency fund, and being more deliberate in our spending. Thanks for the giveaway.

We’ve done Dave’s Financial Peace curriculum, too, and found it very beneficial! We’re getting serious about taking control of our finances and getting debt-free. It can be such a challenge at times! Thanks for Frugal Fridays; I’m new to your site, and I love this feature especially!

We increased our income, and have made some sacrafices.

njfoley at sbcglobal dot net

I just borrowed and read this book from the library but would love to own a copy and lend to friends!! It is going to be a lifechanger for us… we have tens of thousands in debt and have been living paycheck to paycheck for years… with nothing in savings. So we definitely need a Total Money Makeover and are starting to save for our $1000 savings right now!

My tip is to take those small rebate checks and make sure you put them on a debt. Chances are you won’t miss it, but it adds up – I had my car payments scheduled to wrap up 6 months early (and with my tax return, was paid off more than a year early!!) WOO HOO!

We have been focusing on paying off our car and student loans. We paid off one car last year and the feeling of paying off a debt was so wonderful that we became serious about paying off our other debts as well. We did take a short break from debt repayment to save enough money for me to take 6 months off from work after having our 2nd child and it was an awesome feeling to have all the money set aside in the bank to replace my salary in addition to our emergency fund because we lived off credit cards during my first maternity leave.

We have gotten our financial house in order by being more organzied so we can find things like receipts, bills,etc. We are keeping better track of every expense and that has helped us.

My money saving tip is to stop eating out or at least limit it VERY much. My three teens can eat a lot. We save a lot of money eating at home.

We are a family of 8 and really feeling the pinch with gas prices and groceries being so expensive. We cancelled our cable and went to antenna. I coupon as much as possible and sign up for every freebie I can find. I use Groupon and Seize the deal to get deals on activities for the family. I read blogs like yours and I’m trying to learn a more frugal life!

I would love this book! We are just learning about Dave Ramsey and are eager to get out of debt. We have cut back our spending, are making more frugal choices. This blog and others really help!

I started consulting for a company and every paycheck goes directly to pay off our cars! We went from 28,000 in car debt to only 2,000 left to pay off in 3 years!!! 2 years short of our goal!

I use the method if it is an unexpected income put it towards debt. My husband gets extra money for extra duties and all that money always goes on debt! 🙂

I am REALLY cutting back my driving! Gas is crazy expensive and is costing more and more each month. Hard to save when this is happening.

i’ve started reading your blog, coupon cutting, and setting a budget. It’s a start!

This year we’ve actually been making a massive effort to pay off debt. All “extra” money coming in – tax refunds, bonuses etc have all been going into paying off debt. We’re also saving money monthly to prepare for things like car insurance and house insurance so we don’t need to pay those on a monthly payment plan, freeing up cash to put on debt… it’s a bit of a long haul, but we’re happy with the results so far.

I really appreciate all the advice I have been given through Dave Ramsey’s books and DVDs along with websites like this one. It really helps us maintain a frugal lifestyle when we know we’re not alone and we want to be good stewards of the money God has blessed us with. Thanks so much for all the work on your blog!! We want to look into the Dave Ramsey program for kids, too!

I also love Dave Ramsey. He makes so much sense to me. The biggest thing that has helped us is the envelope system – especially for groceries. This may sound dramatic but if you budget ‘blow money’ and pay for groceries using only cash it will change your life. I think it’s a great way to get started on using only cash. Your post was wonderful!

I am working on getting us on a budget, finally! It’s been a scary word to me, because it seems so confining. But I have finally come around to the fact that it’s more about positive boundaries, than about a negative approach to finances.

I am using coupons and only buying what’s on sale at the grocery store – that has helped in the food category. But we could use help with paying down debt. I currently have Dave’s book checked out from the library, but would LOVE my own copy.

We are trying to put back money while my husband is out of work. We need to refocus and try to figure our the best way to reduce our debt on minimal amount of money. I would really like to win this to help get a system in place.

We just paid off the mortgage this past month. Woo Hoo! We’re now using those funds to boost our emergency fund to more than 6 months (I know Dave thinks this is sufficient, but our income is variable and I would feel a lot better with a bit extra in savings) and will shore up our home improvement account and our new car replacement account. I buy and give away many TMMO books. It’s become such an integral part of our marriage and lives, that we enjoy passing these books on. Ironically, I just offered my last copy to someone today, so it would be great to have a replacement copy on hand. Thank you!

We’re on Baby Step 2 of our TMMO and almost ready to scream “WE’RE DEBT FREE!!!!” I’m constantly searching for ways to save money and look forward to the Financial Peace being debt free will bring.

we budget and have been paying off debt. we paid off our last debt (besides the mortgage) on wednesday and i still can’t believe it! i want to work on the mortgage, but a lot of people don’t agree with that one, so it has been a difficult decision to make as to where to go next…

After growing up on things like Shake & Bake and Hamburger Helper, I’m learning how to make more things myself. Over the past few months, I’ve made my own taco seasoning, chicken stock, spaghetti sauce and fudge–all just using things I had around the house. I’m saving money and the homemade stuff tastes better too!

We jsut got a D. Ramsey video from the library and started an Emergency Fund as a result!

Thanks for entering us. 🙂

We have thrown out all of our credit cards and are working to tame our food budget. We are eating out less and couponing. I’ve also started menu planning, making a grocery list, and sticking to it (which was the hard part).

We have been married almost 19 years, and have 5 kids. We have been trying to get out of debt unsuccessfully for years. Now that I am at SAHM, it has gotten easier and we are making progress. The biggest thing that has helped is our food budget. I have been couponing for about a year, and have cut our food expenses in half. Also, cooking from scratch and gardening have helped.

My husband is so excited- he just got a calender to keep track of things and help him be better organized with finances!

We have just this last week upped ours odds of ever payig off our debt when I got a full time job. I would LOVE to get this book and let Dave Ramsey guide with what to do!

We’re getting “gazelle intense” for the first time, and the first step is selling my husband’s car (the one that has a payment attached to it!) Doing so will free up over $300/mo between payments, insurance and fuel. Yeah, sharing a car may not be “convenient” but neither is being in debt for years and years!

Paying off our very last credit card and saving for our next car rather then buying on credit.

I have an emergency fund I’m building on. We need help!

After being unemployed for nearly 2 years, we had amassed over $11,000 in consumer debt in addition to student loans, medical debt, a car loan, and a mortgage. We are currently on track to pay off everything but the mortgage in 2 years!

I have heard so much about Dave and his philosophy of no debt and would love his book to get us started down that road to debt-free living

Am proud of being debt free!! Lost my job in 2009, but had an emergency fund for me and my children to supplement us. Have started my own small biz and make less than 1/2 of what I did before and things are still really tight…BUT, I am still DEBT FREE and I still have an emergency fund — it’s a start!

I am cooking more food at home instead of take out and growing a vegetable garden.

I try to buy most things when I have a coupon

We are down to our only debt being our house. We really need a second car, but are saving up for one rather than having a car payment. We have our $1000 emergency fund and are working on saving our three to six month fund.

One thing I have been doing to save money is making toys for my daughter out of boxes. She has a toy microwave, stove and a sink in progress instead of us buying her a play kitchen. If she gets tired of them or they get broken, we can just recycle the cardboard.

Hey Jessica, I tried to leave a linky. But I don’t think it let me.

http://davisfamilydoodles.blogspot.com/2011/04/tough-financial-times-learning.html

Thanks for the chance to win!

Jessica I am so sorry I left two links (81 and 82) by mistake! I did not mean to try and enter twice I swear 🙂 If you need to remove one please remove #82. Thx

@Stefani @SimpleMidwestMom, Oh gees, I meant remove 81 please. What a day I’m having!

I linked a post on 10 Tips To Save Money on Groceries Without Coupons. Thanks for the giveaway Jessica

Stef@SimpleMidwestMom

We’re working hard to pay down our debts. But sometimes just keeping our heads above water takes priority!

We’ve started our emergency fund by saving our tax refunds. It’s growing, little by little.

We’re just trying to get out of debt little by little, and not add to it. It’s tough! I’ve been wanting to read this book as well as do his FPU. I’d LOVE this! Thanks for the chance!

I meal plan/grocery shop every two weeks and we are going to try our hand at gardening this year!

We have a mortgage and some unpaid debts that we desperately want to work our way out of. Unfortunately, we too were hit hard economically and have not yet recovered. We are not creating any new debt though and have cut up the cards. We live very frugally and hope to get on our feet soon. Thanks for your sharing.

For the first time, last year I grew one plant each of tomatoes, bell peppers, and banana peppers in containers. I was amazed at how much better my home grown produce tasted, not to mention the return on my investment (I spent less than $30 on the project, and bell peppers average between $1 and $1.50 each around here – my one plant probably produced $60-75 worth of peppers over the season, not to mention what my tomato and banana pepper plants added). I plan to increase my itty bitty garden this year.

My husband is in school and we have 2 children with one more on the way. When my husband decided to go back to school, we knew the only option for us was to take out student loans. It was more important to us that I be home with our children than for me to work. Luckily we started out with no debt, but its still hard to be living on borrowed money, but we are blessed to be able to graduate early, saving us from borrowing more and we can’t wait to pay off all our loans, get an emergency fund set up and start saving for our future. I would love to have the guidance of Dave Ramsey as we start out on that journey.

We’re working hard to fully fund our emergency fund and prepare for Baby #2. I have a (not-so-secret) desire to stay home from work after this baby arrives!

Money saving tip that helped me: anytime you receive a raise then figure out how much extra per paycheck is going to be received and have it direct deposited in savings. If you do not have direct deposit then more discipline will be needed. I know you are thinking…people don’t get raises any longer….so adjust and be determined to place any extra money found , made, or received in savings. It adds up. Also the banks that round up your transactions and put extra in savings is a great program. You will be surprised at how much the change adds up to.

My husband and I are following a tight budget, coupon-ing and paying off debt in order to prepare for our 1st baby due in July. Since we are hoping I can stay home part time, we are trimming down our expenses and saving saving saving!!! However, we could really use this book to better prepare for the months and years ahead of us!

Hubby recently got a new job with higher pay, after months of us scraping by week to week, and month to month. After readjusting our budget to start paying on some things we’d let slide as “not essential” (student loans, I’m looking your way), I’m really trying to bank that extra money and pretend it doesn’t exist. Knowing that we can live on less and be okay makes it easier.

I always shop at Aldi and have recently discovered that our Dollar Tree has a small, but decent grocery section and will be going there more often. Since all Dollar Tree items are $1 or less, some things are a better buy there than at Aldi. We are really cracking down on trying not to eat out. Thanks for your post!

We are cutting back on expenses and using cash. If it’s not in the budget, we don’t buy. Thanks for the giveaway!

First congrats again.

Second, we have cut back a lot of places. We cancelled cable and use Netflix/Hulu/Internet. We use white bar towels and hand towels for cleaning (they are bleachable and you can imagine how much papertowels we save).

I’m gonna go talk about this on my blog.

I’ll be back to link!

hugs,

Em

We are trying to pay off more bills.

In the last two years we have been working toward a more independent lifestyle including gardening and buying local, second hand clothing, etc. It has actually been fun and rewarding to see how much we can save.

We are trying to only spend cash on our groceries and our “fun” activities. It seems to disappear so quickly but it keeps us on budget.

I am starting to buy only items that I love. I know that sounds really bad, but if you think about it…. It’s easy to buy something on sale because its cheap (shirt, shoes, etc..). However you waste alot of $$ by it just hanging in your closet doing nothing. Even if you paid $5 for a shirt that you don’t wear thats $5 wasted. I am starting to buy clothing and other items that I love only. I’m super picky! I use to yard sale and don’t do it any more. Its too easy to buy “things” cheaply that add up to lots of $$. Buy just one thing that you love with less $$ that you get alot more use out of. Hope this makes sense!

We are working to build our savings and emergency fund! I would love to win this book – I have so much to learn!

Since I got hit with a health crisis last year I have been mostly out of work and had increasing medical expenses. Thanks to you wonderful bloggers I have been able to reevaluate our budget and make cuts where possible and am learning how to save on necessities. We still have some debt but are doing much better than I would have ever expected. Thank you!

I lost my job about 6 weeks ago, so we are now down to one income, with our third child due in July. While we weren’t ready for me to stay home, we don’t have a choice now. I have started couponing to save money, and we only do the free family events for entertainment. I would love to be a home manager and stay with my kids. We would like to be debt free but can’t see out from credit cards, mortgage, and school loans to see the light at the end of the tunnel. This book would really help!

I really believe that you can do it. 🙂

we’ve been trying to get into using the cash envelope system, rather than cards.

Ooooh, awesome giveaway. I’ve heard great things about Dave Ramsey. Just this month, we made the painful decision that, instead of taking a vacation to see dear friends this summer, we’re going to pay off our second car. It was a tough one, because I was really excited to go (they live in Alaska!) but we reigned in the emotions and did the practical thing.

The best way to save money is to stay out of the stores unless I need something & make a list before going in.

I love Dave too. We went through FPU several years ago. We pay cash for everything and our only debt left is finishing off paying for our van, but we also need to save up some more cash to pay for a new car.

I am in the process of getting our grocery budget lower per month than we have budgeted. Our only debt at this time is our mortgage. Would like to start an emergency fund this year.

I cook from scratch as much as I can that really saves us money

We recently ordered our debts to start our snowball. Now that my husband has a regular income again, we are planning to save half of it each month for our emergency fund and our initial debt repayments. However, a recent development (2nd baby due in Dec!) will warrant another sit-down and discussion. *sigh* We’re so excited though!

Some of the things we have been doing to be more financially stable are as follows:

When I inherited $$ I paid off my house.

What a huge relief that was.

We cut up our credit cards and have been slowly but surely paying them off.

We have been building food and supply storage so now almost everything I buy is on sale which saves me more money! PLUS having food put away is an insurance policy. With 12 kids and 9 grandkids I am at least getting prepared if things get real bad and some of them have to come home.

I don’t have to worry about a roof over our heads nor a meal on the table, at least for awhile.

Oh, I really want this book. We are trying to cut back on the trips to Target, Wal-mart, etc that always seem to be bigger than they should. We are also cleaning out and selling stuff. 🙂

We try to buy on sale and use coupons.

Put your tax return to good use instead of spending it on a vacation, shopping or dining out.

Every year I use my entire tax return to pay down a portion of my secondary mortgage (I didn’t have enough $ to put 20% down when I bought the place). Today after 4 years I am paying off the balance of that $25,000 loan!!

We really need this book right now. As I told my husband earlier this week, I have had enough of wandering through our financial life without a plan, without a goal and most of all, without a safety net.

We have been lucky so far, but lucky can not replace smart. Its time to be smart.

We put our tax return towards paying off our car so we know have a bigger chunk of money available to pay off other debt. Trying to get the snowball going. Great giveaway 🙂

@Christina, we just did this! It is so freeing not to have that big payment each month. And, the money is automatically going into savings each week, since we weren’t used to it anyway, so we’re able to build some savings.

I was raised in a pretty frugal way. Most of my strategies are pretty ordinary and sensible, like buying baby clothes at yard sales, buying produce in season and on sale, and so forth. So I thought I might share some thing I do to stay active on the cheap. I use hulu.com and yogatoday.com for free workout videos (yogatoday posts a 1-hour yoga work every week that you can view with their free account), I run outside and am dabbling in barefoot running (no shoe expenses and it’s supposedly better for you), I take my kids to the nearby park, go for nature hikes on public trails, groove to music at home, etc. I have other things too that do cost money but I don’t rely on those and I think it’s important that we understand that you don’t have to be rich or have a trainer to be active.

Right now we’ve trying to get completely out of debt so that we can put out money exactly where we want it. We don’t have a lot of debt, but we want it all gone! I love Dave Ramsey but haven’t had a chance to read any of his books yet. The waiting list at the library is at least 9 people long, so I would love to get my own copy.

we have one vehical almost paid off and spent yesterday gathering our medical bills, of which there are many! (over $5,000 worth) But gathering them and seeing what we have we can start paying them off entirely and which ones we need to set up payments on. The emergency fund is one thing we really need to work on. And planning ahead for known expenses, like new van tires etc.

I’ve never read the book but listen to Dave’s radio show, and am trying to get the whole family on board with his approach. Thank you!

We are cutting back our grocery budget and doing a better job watching sales and using some coupons. I think we’ll be saving 100-200 a month! So exciting!

We have taken several jerky steps toward financial freedom the last few years only to take huge steps backward it feels like. I would love to own the book (only ever read it on loan from the library) so we can finally make some good progress!

I try and put as much money I can in my savings account now . I had a goal and have reached it and now the next one is starting to invest. As a grad student its been hard, but I don’t mind not going out because I know it will be better for both my wallet and me!

Great job, Mama!! We LOVE Dave Ramsey too… would love a copy of his book.

I’m blessed to have a very thrifty, debt-hating husband! We own our home and both our vehicles without any debt; no credit card debt either. Our only loan (and it is pretty small) is from a real estate investment.

My husband is a pastor (of a small church) so it has definitely taken concentrated effort and hard work for our family to stay debt free. It is so worth it, though! God blesses and stretches what we have as we seek to honor Him with our finances!

We are no longer using our credit cards. I have started making my husband take is lunch andbeen getting up every morning and fixing his breakfast too. We have the emergency fund saved and paying off stuff as soon as we can. I can’t wait to have no bills or have at least smaller bills it will feel so good Just hope I can keep husband on board wish me luck

We haven’t really gotten started on any specific “plan” yet. But I know that we need to. We have 2 credit cards with $500 limit on each one, so we don’t rack up credit card debt. Our problem is setting money aside for an emergency fund and leaving it alone. My husband likes to spend but I like to save so we need to get on the same page about our emergency fund. Once the money is there – leave it alone.

Thanks!

Linked up a post on cloth diapers. GREAT way to save money!

I love Dave Ramsey! We took Financial Peace University several years back at our church. I do feel like we keep falling off the wagon, however, in our budget/planning. But, I have to keep remembering….baby steps!!!! Thanks for your encouraging words! 🙂

We’re actually doing okay right now, but the increase in gas and grocery prices are starting to concern us. We have an emergency fund, are trying to pay off our only debt (credit card), and trying to curb unnecessary spending.

My first step to getting serious was listening to Dave’s radio show. I’m waiting for his book to be available at the library but would love to win one too!!

Right now I’m focusing on bringing our grocery bill down. Even though I cook quite a bit from home, I’m planning well enough ahead to do it as frugally as I could.

I have been really intrigued by this book and would love to get a copy of it!

We have been buying more food in bulk to avoid multiple trips to the grocery store, and avoid eating out. I have also switched to generic diapers as well, in hopes that we can see a difference.

I’ve been working hard to get our finances in order. I do all of the money stuff and we’ve paid off over $5000 in the last year. It might not be a lot to some but with one income, a new-to-us house, and little ones I think we’re making progress. I’d love to read the book to give me more motivation on saving and paying off more debt.

LOVE that SNL video!! Classic.

We are coming to grips with our situation. We just found out we’re expecting babies #3 and #4. We just bought a used (not new) van with good mpg and are planning to sell my older car that was paid off to go towards the other vehicles hubby’s truck balance to get it paid off and we will be back to one car note, and we’re on one income.

We are also DIY remodeling (an absolute necessity for our growing family) our house with affordable materials and are blessed with friends that are skilled in carpentry that want to help us.

I have been doing okay with couponing and doing without somethings, but we need real help!

Thanks so much for this opportunity!

My husband worked very little last year and was laid off in November. I’m a teacher in CA, so we are seeing major cuts to our salaries and increases to the costs of our health care benefits. We are a family of 6, so it’s not cheap to feed, clothe, and house a family of 6. We’ve eaten through out emergency fund and haven’t been able to replace it. We are slowly whittling away at our debt, but I still feel so deep in it! I’ve been hearing about Dave Ramsey for quite some time and would love to read his book and put his practices to use with our family budget.

@Brenda, I feel your pain. My husband was without FT work for 3 years. I lost track of the times I prayed for God to give us what we need to meet our needs and responsibilities. It wasn’t always perfect but we made it through.

Five people on one income is tough. When I came home to Home-school my children I rearranged alot of our financial spending. No Credit Cards! Smart grocery shopping and really teaching my kids about wants vs. needs. They make better $ decisions now and it keeps me accountable when they are watching what I do to see if it lines up with what I say. We have a garden to cut the cost of food and help prepare for the times when we don’t. We have become very creative in recycling our “stuff” and in the end that has cut down spending too.

Praise God for His provisions!

Buying less, cutting back with hopes to pay off our home in the next 2 years (as well as our vehicles!)

Have stopped my impromptu Goodwill trips. Even those have added up!

I would love to win this book!

Before we moved here (’08) we were debt free and had some extra money from our home sale to do a project in the backyard that NEEDS to be done. But immediately after being relocated by the company, my DH lost his job and we had a new baby on the way (due in 6 weeks) and we accumulated debt. 🙁 Now, 2 years later, we’ve struggled to get out of that hole from his job loss (he was out of work nearly 6 months). We are expecting baby #3 and are wanting to put together an emergency fund and pay off the debts, but it’s been slow going. 🙁

Well, I have read some of Ramsey books, bought some of the DVDs of his University program. I have his workbook and we had a large sum on our only credit card, and paid it off recently! 🙂 Yeah!! Now we have a student loan (my loan) to pay off…hopefully by next year. We invest, have a good amount saved up. No mortgage yet…(military family) —So, I think we are on the right track! 🙂

Paying down credit cards (and not putting more debt on them), and putting a little bit of money away each paycheck for this summer’s vacation. Those are pretty big steps for us.

Thanks for the chance to win!

Thank you so much for talking about Dave! We are huge Dave Ramsey fans! My children and I listen to his radio show every day and love debt-free Mondays and Fridays. We cheer with people who call in to shout, “We’re Debt Free!” We are debt free except for our house and LOVE it! Sometimes it is very hard to delay pleasure but it is WORTH IT. Keep spreading the word. Financial freedom is possible. Thank God for Dave and his ministry!

Setting a budget is SO vital. A budget must be set and followed. One thing my husband and I do is we get a set amount of cash every week to spend on lunch etc. When the cash is gone, we know we can’t spend any more until the following week. We found this keeps us much more aware of our spending rather than just using the debit card whenever we please.

Thanks for sharing your stories! Love reading them. I have never “done” Dave Ramsey, or read his books, but I have used the envelope method since I can remember. My husband and I have never owned a credit card..( just our debit cards) and the only debt we have right now is my van. We live on less each month so that we can put funds in our savings & IRA account. Our other Marine family/friends may have nicer things than us, but it feels good to be “free” compared to many others our age ( 27 & 30) who are bogged down with thousands in debt.

We are working on getting our emergency fund bigger. We also paid off one of our vehicles last year, so I’m setting that money aside for either car repairs and for when we will eventually need a new one.

We gave up debt for Lent. So no credit card useage at all! This was tough for us because we would use it for silly things that we think we needed but didn’t. Now we are working on paying them off and it feels so good.

@nicole,

Gave up debt for Lent? LOVE it!

@nicole, awesome!

I would love this book so my husband and I could read it. He retired too early and does not grasp frugality at all. He believes if he has a nickel in his pocket he wants to buy something for a nickel. He actually accused me of putting stress on him because I wouldn”t let him spend money since he has retired. He makes less than half of take home pay than when he was working He really needs help!

My money saving tip is to buy second hand whenever possible. With small kids it is very easy to find nice second hand stuff.

We are getting out finances in order. We have our emergency found established, paid off all our debt and are now working on saving 6 months worth of living expenses in the bank.

We are FINALLY starting an emergency fund. The idea makes me giddy – lol!

Working on getting to be debt free. I am selling stuff on Craigslist and having a garage sale all of those dollars are going to pay down debt and go to savings.

We’re trying to live primarily on one income and use the other one to pay off debt. We only owe on one student loan and our house – if we can stay motivated both should be paid off by mid 2012! I haven’t read TMM, but I’d love to in order to help keep us motivated.

We are divying up our tax return…some paid off debt, some goes to a beach trip (for the kids), some to fixing the huge hole in the living room wall (!), and, finally, the rest in a savings account (can you believe we have had NO savings for over a year?!) I would love to win the book- we have a long way to go. Be sure to click my name for a Make Money from Home blog series.

We’re using a Budgeting program called “Budget” and giving that a whirl, sticking to a set amoutn for spending money, groceries, etc.

When we got married a little less than 3 years ago we had no debt. When we got orders to South Carolina and drove out here with almost nothing and found a nice apartment that we could afford we realized we didn’t have any stuff!!! We went out and got a bedroom set and mattress with 0 percent interest for 6 months… we luckily paid it off before it started getting interest applied to it but it took us longer than we thought it would and we decided then that we wouldn’t buy anything unless we saved up the money to buy it. The only thing we’ve bought without the money is a house after we had our first baby. We started listening to Dave Ramsey on the Radio and love what he teaches!! We are debt free except for our house, have 15 percent of our income going into retirement, an education fund for my daughter and one for me (I didn’t go to college). We are paying extra on our house and saving up for a second car (hopefully SOON!!) We are expecting our second child in June and we are so grateful to be financially stable!! I am 22 and my husband is 26 and we know we’ve started our family and our lives out right!!

I’m starting on my emergency fund. I’m only able to do $10 a payday right now, but at least I’m finally getting started!

Thank you for saying “we hope to stay that way, God willing” after stating you are debt free except a mortgage. Some bloggers are so smug in this. They are trusting in their own “wisdom”. I always think of Corrie ten Boom’s statement to hold ones possessions with an open hand. Yes it is important to have an emergency fund……..but it is MORE important to trust in Jesus Christ. Sadly, there seems to be a lot of blogging about paying off debt and saving hoards of money, but little in these blogs about helping the poor and being a servant. As though because someone does not have 6 months of expenses saved up, they are not deserving of grace and mercy.

Glad to know that you seem to have figured this out and instead of preaching the gospel of Dave Ramsey, you speak the truth of the gospel.

For 40 years we have lived on one paycheck – my earnings went to savings to pay for vacations, college, etc. We paid off our mortgage in 8 years. We make freezer meals and use coupons.

p.s. Got my Dr. Scholl’s socks yesterday! Love them! Thank you!

We are saving for a down payment on our first house. I’m a Dave Ramsey fan!

Our only debt is our mortgage and we’re fortunate enough to have an emergency fund but I still think there is so much more to learn about budgeting and saving. We’ve started keeping track of where we spend our money every month to see if there are areas where we can cut back.

We have done a few things to help cut down our expenses and smartly prepare for the future. We are young….23….just starting out on this journey. We are so thankful for the wisdom of the generation before us who were willing to share their failures and successes.

We only drive one vehicle. I stay home with my daughter and drive my husband to work once a week to go to Bible Study and run errands. We have a one month emergancy fund built up. We do not use credit cards. We just bought a house, but we bought it as a foreclosure, so the price was incredible. We have debt on our school loans and our house. We are hoping to pay off my school loans with in two or three years. We want to be completely debt free, including our house, by the time we are forty. We clip coupons and try to live frugally.

We try and store a lot of food essentials so we can always have that on hand. We garden and preserve/can most of it. We are also working on building up our emergency savings fund and really trying to stick to our budget.

We have a very SMALL emergency fund. We also used the money we got back on our taxes to pay off all of our credit card debt. Now only 1 truck, 1 student loan and 1 house to pay off!!

I am trying very hard to get out of debt. I am somewhat using Dave’s system (although I’ve never read the book). I only leave myself $30 a week for personal money (i.e. lunches out, coffee), although I’m about to drop that down to $15 since I don’t ever spend it all. I only spend $75/wk on groceries, toiletries, etc. for our family of 4! Our van was not supposed to be paid off until January of next year (from a buy-here, pay-here place), but every bit of extra money I have, I immediately put toward the van, before I have a chance to spend the extra money. So, now the van will be paid off in 2 weeks, which is really great since my husband will likely get his very last unemployment check in about a month!! (Shew – just in the nick of time!!!) I’m hoping to get our student loans paid off next. I’m determined to make this happen!

we are working with a debt magmt prog and are paying down our debt. it feels good and it is working. we have reevaluated our life and have changed to a much more frugal lifetstyle!

We have our emergency fund and are working hard to stay on our budget. I do a little part time work for my inlaws to save up for bigger projects I want to do, so this helps

We don’t use credit cards anymore, if we don’t have cash for it we don’t buy it. I am working really hard to have a budget that works for us.

We are over our heads in debt and finding it hard to make any progress to get out. We’re not using any credit cards, but don’t have money to pay more than the minimum. I would love this book to help us change our ways and teach our kids to be financially stable from the beginning.

My husband was laid off for a year and a half. We have three children (very active in sports/school/band, etc) I work part-time and took on another part time job (typing from home), he mowed lawns, plowed snow and helped anyone who needed it. During this time we started an emergency fund, paid off a credit card and a car loan. Bottom line is buy only what you need, save what you can and you will weather the storm.

I’d love a copy of this book! I’ve been working on cutting expenses on food by using coupons and not eating out as often. And I’ve stopped impulse shopping…I make a shopping list and stick to it. While we have no debt other than our mortgage, I’d still like to feel better prepared for an emergency.

We have our e-fund and we are working to pay off debt right now. We really don’t have much thank goodness.

We’re working on our debt snowball and will have our car paid off next week. There’s only one other debt and the mortgage to tackle. It’s such an exciting time for us! We’re looking forward to having the freedom to give where God’s working!

We paid off our credit card a few months ago.

We are finally debt free including mortgage but it took us 40 years to reach this point. I would love this book for my daughter who has so much to learn about finances.

Great tips. We are on track w everything (not that we’re perfect).

I am leaving instructions for making your own coconut milk — EASY and CHEAP!!!

Enjoy!!

I am reusing items I already have for our new baby due in Nov. I plan on using a oversized bag for a diaper bag, a plastic drawer set for an dresser, and etc.

I got an ING savings account for our emergency fund. It gives us a higher interest than our credit union and takes about 2 days to transfer money to our checking account. It has been very helpful when weighing “emergency” vs. “non-emergency.”

I took a part-time tax season job to help pay expenses and buy groceries.

We’ve been really bad with money–my husband is a spendthrift, and I’ve picked up many of his bad habits. We have, however, been convicted on our bad money habits. My husband recently invested in Mvelopes when they had a promotional rate of $34/year, and we used his bonus and tax money to pay off our credit card and pay a few medical bills. We still have a lot of medical bills, a student loan, and a house loan, but we’ll soon have our $1000 emergency fund in place and start our snowball with the money we used to spend on credit card payments. If we can get past our inertia, we will have the medical bills paid off within the year and really be able to hit the student loans and mortgage payments. It’ll take years to undo our poor choices, but it took years to get into this mess.

I’m so jealous you’ve gotten to do your debt-free scream already. We’ve been on Dave’s plan for 2.5 years and it’s been crazy. We’ve had a baby, an appendectomy, a hernia repair, 4 root canals, and 2 cars break down. Murphy has camped at my house. Thanks to Dave we were able to cash flow most of it, but it’s depressing to be working so hard for so long and be more in debt than when you started. 😛 Congrats!

Hang in there. I remember when I thought it would never end. And then all of a sudden we got over a hump and it was over. Kind of like a bad roller coaster ride. You can do it!

trying to pay off debt as we speak! We are hoping our house being sold will ultimately put us at those goals, and the place we plan to live in will help us to save up for the down-payment we need to get back into another house -but no other debts this time! Thanks so much for the give-away!

We’re snowflaking our way to paying off credit card debt–I made a paper chain with each loop representing $100. It’s a great visual to watch it getting shorter.

Hey there. Well, I thought I’d join in the conversation. I am an avid reader, but this is my first time to jump on in. I am sooo interested in learning to save money and live frugally. I have been reading on it for the past year, but for some reason it hasn’t STUCK. We keep spending and now we are in a hole. Our worst habit is eating out. I have been freezer cooking though (in small portions) to help conserve what we have and make time in the kitchen easier. For example, I made a big pot of beans and mexican rice (got both recipes from your blog and they turned out super yummy! thanks!) and after dinner, I froze extras in meal size portions for chili, burritos, taco bowls, and other creative ideas to use up beans and rice! Anyway, I am rambling….sorry 🙂

Oh, also, it is my first time “linking up” and I wasn’t exactly sure how to do it and I accidently linked up twice. I am number 24 and 25. If you need to delete number 24 (the one I messed up on) that is totally ok..I just didn’t know how…and I don’t know how to link back up to your blog on mine…maybe someone could reply to this and tell me..or you could shoot me a quick email…sorry! 🙂

I have tried using mint.com to balance our budget, but I find that it still gets out of hand because we use ATM cards and credit cards. I really need help from God and a good financial expert to figure out this whole budgeting thing. We just had a baby in November, and need to get serious about becoming financially free.

We don’t get into debt. Other than our mortgage payment we don’t have debt. If we can’t buy it with cash we don’t get it. We are also making double payments on our house and will pay it off in the next 5 years. So no debt at all! 😉

I linked up a post about an easy toddler craft this week. Thanks for the chance to win. We actually checked this book out at the library. Thought about buying it but didn’t want to spend the money. 😉

We paid off the last of our credit card debt and paid off our truck with our taxes. We are now down to only our mortgage!

We had a baby at 26wks that required a lot of assistance and I had to leave my job which pretty much killed any savings we had. I discovered coupons without any blogs and somehow mastered it. i wish I would have known about you and all the other blogs out there for deals, I think we would be in a better place. We recently started the cash envelopes, we are on our 3rd week and so far rocking it! We are in a huge debt that will take us years to repair, I believe that this book will help us. Thank you

It’s never too late!

Good for you for getting out of debt! We only have a car payment that has a 0% interest loan on it.

We are going to be paying off our credit cards this week!!! I’m very excited but I know there is so much more we need to be doing and probably could be. I would love to own this, maybe I could even get my husband to read it.

This past December my husband and I had 3 months of living expenses in an emergency fund if BOTH were to lose income. When it got down to 9 degrees outside we started to notice how cold our house was feeling. $5000 later, we needed a new heat and air unit. That left us with under $1000 in the emergency fund. I was so thankful to have the cash at hand to pay for the unit as I had a newborn and a 2 year old to keep warm. Now, 4 months later we are over the $3000 mark and will keep on tucking. I am also doing a cash budget for things like food/entertainment/kids clothes allowance and my husband and my play money. I bought myself a brand new pair of tennis shoes today with my “play money” and it felt good not being guilty that I made the checking account dip a bit lower because it was out of my cash fund!

We have no debt but our home, and we’re trying to pay that as fast as we can. Our income is limited so I make use of coupons, Swagbucks, Mypoints, etc. We try not to buy much.

Some friends of ours purchased Dave’s FPU DVD series and we borrowed it. (Saving money here!) We are in our second month of the budget and debt snowball. So I guess that’s baby step #2. We really enjoy watching his seminars and would really like to have his book. (Our friends didn’t have the book)

It’s been like having drug withdrawals to not be able to spend money, but I (The spender) am learning to cope a little better each day. I keep looking around my house for things to sell so I can pad my “Blow Money” line in the budget a little more. We will be debt free by the end of 2013…It seems like a long time, but certainly a lot sooner than the track we were on! Thanks DAVE!

Since the arrival of our little one, our switch to a one income household has been a little rough financially. I think my next step is to do more freezer cooking to have thing on hand when I’m too tired to cook and we’re tempted to eat out.

We are working on paying off my student loans and paying off our mortgage early. I think we are doing pretty well, but I’d love to read the book to inspire us.

We live paycheck to paycheck, and are desperately trying to start putting money away for an emergency fund. It’s so hard finding the extra money! We’re also looking at different things that we can cut out, like cable and looking for a different phone and internet plan. I would love to have a copy of this book, as I’ve seen it help soooooo many people get out of debt.

@Renee, don’t discount this! We were able to swap cable internet providers (which we need for my husband’s school) and saved $75 a month!

Check your library. They should have the book

We planted a larger garden this year to help with the grocery bill AND eat better food. Savings add up over time if you’re consistent. Thanks for the chance to win a great book!

We are currently working to pay off a student loan and our mortgage. We hope to be completely debt free in 5 years. I love Dave Ramsey. I stream his radio show during the day. I just love to hear people scream, “we’re debt-free”.

Thanks for the link-up.

I’m with Julie. I think we do ok but there is always room for improvement. I need to keep better control over my random spending. Right now we’re working on determining what type and how much life insurance we need. Our only debt is our mortgage, that is something we are very pleased with.

Love the SNL video. Words to live by.

Preparing the best way- learn to do without even when you do have the money.

I discovered couponing in October and have been implementing what I’ve learned from couponing/frugal living sites. I’m also educating myself about freezer cooking and looking forward to shaving more off my grocery budget. I have been so inspired by Dave Ramsey and all the great money-saving blogs out there! I’m actually enjoying the “debt-free” challenge and I’m learning that those little savings here and there add up. Who would’ve thought that clipping coupons and cooking from scratch could be so empowering:)!

Working on paying off the credit card (we’ve been under-employed for several months and we’re self-employed) and a couple medical bills.

Then back to building up the emergency fund and savings.

Would LOVE a copy of this! Is it weird to make it the bed-time reading material for the kids? 🙂 I think we do ok but there is always room for improvement!

We only have one debt – our mortgage, and we are working on a plan to pay that off early. We need new windows for said house, but we are not touching our emergency fund, we are saving up for it and will pay cash when we can, probably doing it in 2 or 3 steps.

We just don’t spend money we don’t have. That really is the catch. Save up until you have all the money, then buy it, not the other way around.

My husband and I have never been good with money, but recently God had laid on our hearts that we are not being faithful with what He had given us, so we decided to really crack down and be frugal the way we knew we could be! My husband took my debit card away(it was ok) i started actually using the coupons i clipped, and we try to go to the store only once a week so we arent tempted to spend extra money!

I first read this book right before I got married, but I loaned it from the library and would love to have my own copy to reread. Thanks to Dave, we have an emergency fund and we have paid off thousands in the past 2 1/2 years, but our snowball seems to be kinda stuck now. I’m going to reevaluate our expenses and also try to sell some on etsy and ebay- trying to find some snowflakes somewhere :).

We took Dave Ramsey’s Financial Peace University last summer and have been following the baby steps. We are out of debt! yay! We also have been trying to reduce our expenses so that we can save even more (and pay down the mortgage). I have never read the Total Money Makeover and would love to! Thanks!

Well, we have our emergency fund as of this week. We are trying to sell a rental property/business, it’s been tough in this real estate market. Once we get that out of the way I hope to get our snowball rolling!