Getting Out of Debt By Reducing Expenses

As an Amazon Associate I earn from qualifying purchases. For more details, please see our disclosure policy.

Want to save this post?

Enter your email below and get it sent straight to your inbox. Plus, I’ll send you time- and money-saving tips every week!

The last couple weeks I’ve shared bits and pieces of what FishPapa and I did to get out of debt. If you missed the first few parts, you can start at the beginning.

Once we stopped using credit cards and started listening to Dave Ramsey’s free podcast, we got into the habit of writing a new budget at the start of every month. My husband was self-employed; I was a stay-at-home mom with a very small work-at-home income; and we had five young children to care for. We saw that we had to drastically reduce our expenses if we were going to make ends meet without relying on a credit card to fill the gap. So, that summer, we got serious about our spending and cut costs wherever possible.

Find Money by Spending Less

Here are the main areas where we “found” some money by spending less.

Telephone: Like most, we looked at caller ID and call waiting as necessities we couldn’t live without. T’isn’t so, my friend. We cut beaucoup bucks off our phone bill by doing several things.

- We eliminated all those extra services. No caller ID, no call waiting, no voice mail. {Gasp.} And it’s really okay. We bought an answering machine for $12 and screened calls that way instead of using caller ID.

- We cut our services all the way back to basic which is about $30 a month. No more long distance. Since we already had cell phones for my husband’s business, we didn’t need long distance on our land line.

- We kept our cell phone plan at its 500 minute level and simply learned to make our calls at times that were “free.” Was it inconvenient? A little. Did I talk to my mom or sisters as much as I wanted? No. But, with email and free weekends, it has been fine. Plus, the extra $80 in our pockets was totally worth it.

Food: Beans and rice, rice and beans, baby. It may not sound super exciting, but it’s cheap eats. We ate that meal in its various forms (burritos, tostadas, taco bowls) quite often. My kids really looked forward to the 1 or 2 nights a week that I served meat. But, everyone was healthy and I lost so much weight, I fit back into my wedding dress by the end of that summer!

For the first year of debt-fighting, I haphazardly used coupons, but then I discovered the world of online deals blogs and started to change the way I shopped. Shopping with coupons and stockpiling has reduced our expenses down to $600/month for a family of 8, eating on an extravagant level. (When things were really tight, we squeaked by on about $400/month.)

Entertainment: Again, we cut back to the bare minimum. Once we realized that we were living the high life on someone else’s money and that dinners out were going to cost us more in the long run, we stopped doing anything “extra” that cost money. At-home date nights became a regular feature in our lives. If we had a date night out, it was thanks to friends providing free babysitting and a Buy One Get One Free coupon at the local hamburger joint. Cheap dates are easier than you think.

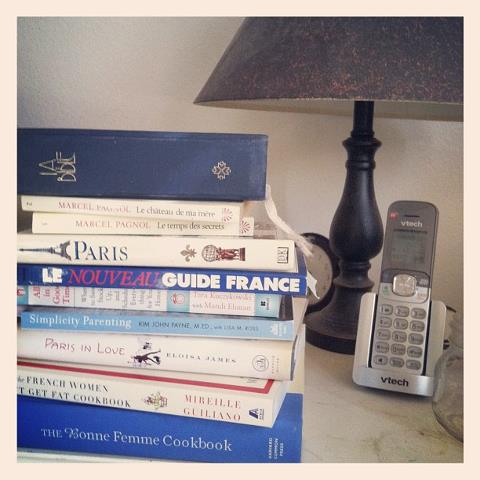

We didn’t deprive our family of all fun and games. We just focused on the experience, rather than the expense. Books and movies are free at the library. We busted out our board games. An evening picnic at the park didn’t cost us a cent. There are all sorts of free family fun activities to do. You just need to be creative.

This wasn’t all we did to get out of debt, but these are three simple areas where most families can cut some fat in the budget.

Part 6: Increase Your Income

What do you do to reduce expenses? We’d love to hear it!

I love all of this info on budgeting and cutting back debt! Does anyone know where I can find a good coupon blog to follow that is specific to my home town? I had one for awhile and then somehow lost track of it. Thanks!

@Whitney Cheek, google “the frugal map.” You should find something close that way.

Thanks for the great insight, not only moms can use this, but college students needing to make every dollar count!

Amy

Hey,

I recently came accross your blog and have been reading along. I thought I would leave my first comment. I dont know what to say except that I have enjoyed reading. Nice blog. I will keep visiting this blog very often.

Thank you

🙂

Keep blogging

http://studentsblog2.blogspot.com/2009/10/how-to-get-out-of-debt-learn-tricks.html

Sounds like a lot of great ideas. Thanks to everyone for chiming in. We have to beat the system in order to stay afloat. Not every "necessity" really is.

I am definitely going to cancel the long distance on the home phone after reading this! We just went on a camping trip which was cheap as far as vacations go, but I noticed that what made it even more econimical was sharing resources among three families. We didn't all need to own the same equipment or buy the same supplies and we also shared meals and snacks.

My husband and I have been debt free (except for the home) for 9 months now. One of the things not yet mentioned that worked for us is to ORGANIZE & MINIMIZE. I went through all of the closets, drawers, shelves, etc in all of the rooms, office, & garage and organized it. We rid of all of the stuff we did not need either by giving it away or selling it on ebay/craigslist. Now, everything has a place in our house. When I am out shopping and feel the need to buy something, I ask myself, "Do I really need it? Will it be used in the next 2 weeks?, Does it have a place in our home?" If I can't answer 'yes' to the questions, then I do not buy it. Surprisingly enough, this has greatly reduced our spending. We are no longer buying things we don't need or things we already have but cannot find. Plus, this has been great for my state of mind.

No Satellite/Cabel for us. Most of our shows can be watched online at the network's website for free if we miss it during it's scheduled time.

No long distance on our land line. I have my 5 favs with tmobile and the minimum minutes package. I can talk to my 5 favs as much as I want for FREE no matter what time or day I call.

We eat leftovers or turn it into a new meal instead of tossing it.

Date nights out are free with our Discover Card rewards. I know this is a bit touchy because some don't want to use credit at all, but we use our Discover for most everything (and pay it off or – at least 75% of it during months with stuff like Christmas/Bday/Back to School – every month). We get a percentage back, instead of redeeming it for cash we do it for giftcards to movies, restaurants, clothes shopping. Since you're redeeming it for their partners instead of cash they turn 40 into $50, etc. So you're actually getting more back.

There are so many new blogs I'm visiting today that have great articles. Thanks for hosting! I've made the "bean brownies" that Amy from SGF is talking about. They are delish and my veggie hating hubby approved of them too 🙂 Our phone and tv bills are already low. There's a newer local company. We get phone, high speed internet, tv, and HD for about $100. I think we could do without the HD and save $10 per month, but it's football season now. I read about someone who uses coupons when stuff is on sale. I've been trying that lately and really like it. DH built a projector so we have our own movie theater. On rare occasions for that must-see movie we'll wait a month and see it at the cheap theater.

Wow, 90% of what you posted today are things that my hubby and I do! It's always nice to know we are doing good! LOL

Those are great tips:-)

Phones take a lot of money. We actually reduced our cell phone bill by not renewing the contract when it expired. I only miss it sometimes. Especially when I have baby brain and can't remember my own phone number. We ended up getting the MagicJack. Its not for everyone, but it replaced our home phone, and for the price of a few hardware items and a home phone with multiple handsets, we pay a couple of dollars a month for our phone. Plus we still get free long distance, a huge plus since we have no family locally and my mother can talk for hours and hours.

I am at home all day and instead of adding tons of minutes to my cell phone package I subscribed to Skype – $3 a month. It's great. The only drawback is that I have to be at my computer but there is a way to use it with a normal phone, I don't have a need for it right now b/c I am a mom to 4 dogs, not kids. 🙂

This is my first time joining your blog carnival – I shared a brownie recipe that uses black beans instead of gluten-free flours. This is much cheaper AND it tastes great. It's also a fabulous way for moms to get healthier foods into their kids without the kids knowing. 🙂

We started our Total Money Makeover at the end of August and we've learned so much! For the first time in my life, I've written and followed a budget. Crazy that it's taken me so long!

Great blog! We are also on Dave Ramsey's plan and have dramatically reduced our debt and will be debt free except for the house next year. Couponing and shopping the sales have been eye opening for us. We have stockpiled our food pantry/freeze at 50% of what we normally spend and have challenged ourselves to eat only what we have with the exception of buying dairy for the next two weeks. The leftover money we have in our food budget will go toward our debt. I would also add to your blog the power of prayer. God does not want us to be a slave to the lender and if we ask for help, change will come!

I agree with you on the removing caller id/call waiting we removed it almost 8 years ago and it hasn't been a problem.

Nice blog, and congrats on effectively cutting back on your cell bill. To augment your important tips about lowering wireless costs, I wanted to add that I work in the consumer advocacy division of the company Validas, where we electronically audit and subsequently reduce the average cell bill by 22 percent through our website, http://www.fixmycellbill.com. Put simply, Validas guards against the frivolous and unnecessary charges that over-inflate an estimated 80 percent of cell bills. You can find out for free if fixmycellbill.com can modify your plan to better suit your individual needs by going to the website.

For more info, check out Validas in the media, most recently on Fox News at http://www.myfoxtampabay.com/dpp/consumer/conlaw/lower_cell_phone_bills_072409.

Good luck to everyone reading on further reducing your wireless expenses in this tough economy.

Dylan

Consumer Advocacy, FixMyCellBill.com

It's amazing how all those little things add up to HUGE amounts long term, isn't it? 🙂

Great tips! We're following Dave Ramsey's plan right now.

Another great week! Thanks for hosting!

~Liz