How to Keep Better Books

As an Amazon Associate I earn from qualifying purchases. For more details, please see our disclosure policy.

I’m resolved to keep better books this year. True story.

Want to save this post?

Enter your email below and get it sent straight to your inbox. Plus, I'll send you time- and money-saving tips every week!

Over the last month or two I’ve spent a fair amount of time playing “catch up” with our finances. I did what I told you not to do, I went months without reconciling the checkbook. Oh yes. The irony in writing a post entitled, Do Bookkeeping Often.

I knew we had money; I check the bank balance regularly. But, making sure my records were in order? Major fail.

I spent several days sitting at the computer, entering transactions, figuring out categories, and making my accounts reconcile with the bank’s.

I found out that I’m not the only one who does this “putting off for tomorrow” kind of thing. My sister and a friend both have lamented the same. And my own tax lady got my taxes done before her own. Thankful that there are other folks in my same boat.

This year I’ve decided that I’m going to keep better books. For reals. Organized feels like prepping for taxes in a (relatively) painless way.

I’m doing a couple things to make it happen this time.

1. Set a regular date.

I’ve decided that Mondays are the day to fill in the transactions of the week previous and have a money meeting with my husband. As a result, we’ve talked about things that I hate to think about and often put off, like refinancing our rental property, getting life insurance, and being better about retirement investments as well as the regular questions of what do we need to buy or pay for in the next few weeks and how can we save more money.

If we talk about it on a weekly basis, we might actually fill out those loan papers and sign up for the life insurance.

2. Make it easy.

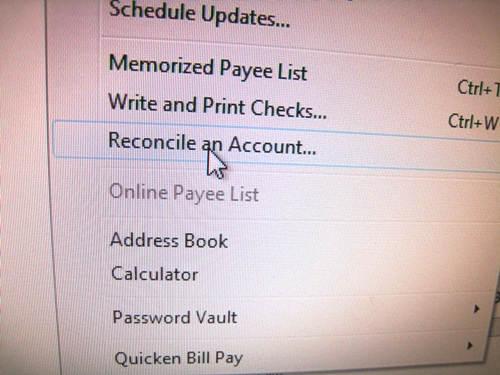

We looked at a bunch of different bookkeeping apps and such, well, hubby did, and came to the conclusion that Quicken 11 works just fine. The problem is not the app or the software, it’s the person entering data. I don’t think learning a new system will make my bookkeeping better, actually sitting down and doing it will. See point #1.

I’ve used Quicken for 16 years and I understand how it works. It provides the info that we need for taxes. I’m going to guess that I could learn more about the program and it would do even more for me. But, it’s good enough and it’s easy.

3. Organize it.

I’ve done a few things to make bookkeeping and bill paying easier this year.

- I pre-printed address labels for our rental company so I can quickly get the rent check in the mail. I’ve also pre-addressed envelopes for quarterly taxes.

- I set up a Taxes 2013 file to hold important documents that might come throughout the year.

- I’ve got receipt envelopes labeled for every month of the year for storing receipts after I input the information.

- I printed multiple copies of my Financial Stats tracking form to make money meetings easier to put together.

- I put together a new finances notebook that includes all the account information and the above mentioned items, so that it’s easy to locate as well as a help to my husband in case something happens to the resident bookkeeper (me).

4. Reward thyself.

I very rarely buy something for myself just because. Sitting at the computer for days at a time costs me something. So, why not put the two together and reward myself for staying on top of things.

This month I treated myself to the Blu-ray copy of Pride and Prejudice. Oh yes, yes, I did. I figure this is fabulous incentive to keep better books this year.

Keeping better books in 2013 will save me time and money and a few headaches, too.

Got a tip for better bookkeeping?

Tell us! This is Frugal Friday. In an effort to make these weekly financial discussions more interactive, I’m no longer posting a link-up. Feel free to leave a link in the comments. But better yet, chat with us on today’s topic.

You own a rental property but you rent the home you are living in? I would love to hear why you decided this.

Ha! It’s called making a bad investment. When we moved to Kansas City, we bought a home to live in and about a year later one to flip. We ended up remodeling the investment property and renting it out. When we moved back to CA, we were able to sell our residence, but not the rental. The market really plummeted in that area, so we’re waiting for it to bounce back before we try to sell again.

Wanna buy a house in Kansas City?

I would love to hear more about your financial notebook. How you organize it, what you put in it, etc. I am searching for a method that works for me. Of course I suspect it might just be a similar case to your “It’s not the program, it’s the person entering the data.”

It’s mostly all those pages I listed above. It’s nothing fancy. It mainly keeps all the account info and passwords and the things that I need to mail.

Hi Jessica, I love your posts. This is a great one! Tax time is sooo stressful when I’m not organized. We add living overseas, traveling around a lot, and having a bit of a complicated tax status to the mix. A couple of years ago we couldn’t locate all our important tax documents for that year. Major stress! So for the next year, I made a zippered file decorated with puffy stickers I had around that goes with us when we travel for those items. And it has a printed out list of all the documents needed every year. Super helpful visual reminder of where everything is, or at least where it is supposed to be!

I like the idea of a financial notebook, too. I may try that for this year!

Great technique with the zippered file. You could try one of those zippered notebooks, that way with all the travel, you know it would stay together.

Your opening paragraph really cracked me up – I am so in the same place. We did our taxes last night and now I am promising myself that this year I will keep on top of it. And yes, as a professional organizer and blogger about organizing/homemaking, I find it particularly funny when I don’t take my own advice. lol. I love this post and am setting Sunday nights as our couples planning/money talk time. (Truthfully it has been set as Sunday night for a few years, but we’ve fallen off the bandwagon of actually doing it, but I’m re-committing!) Thanks!

It’s so easy to fall off the wagon.

I am married to a CPA and help out in his office this time of year. Here are some suggestions:

If you get your taxes professionally done, call your professional in late May (not before – it’s still busy) and ask for a short meeting (ask how much the meeting will cost.) Before the meeting, ask if they could take a few minutes at their convenience to look through your files and see if there is anything that you could have done/can do to make doing your 2013 returns easier to do. Ask if they have any ideas on how you may save on taxes for the coming year in terms of record keeping, spending categories.

Keep NEAT files- no falling out papers, no documents stuffed in a bag or a box, no fragments of papers. Remember: the more sloppy you are, the more time your accountant will have to take – and his/her time will be reflected in your bill.

Great tips! Thank you!

The problem isn’t the program, it’s the person entering the data— I need to put this on a post it and put it on my desk. I have tried every month since last November to enter in our spending using and haven’t made it past the middle of the month. I’ve tried several methods (pen and paper, excel, pear budget) and none work. But really I don’t make the time. I think making a set time is the next step. Thanks!

I forgot to do it yesterday (my bookkeeping day). I woke at 4 am this morning and couldn’t go back to sleep. So, I got up and did the books. Technically, the new day hadn’t started yet — I should have been asleep — so I’m counting it as being done on time. 😉

Don’t worry, I’m in the same boat! I’ve been very good this year about setting a budget every month and tracking every single penny we spend. However, my filing is a mess. I’ve read that the simplest way is to buy a 13 slot accordian file. Each section is for one month, and the last one is for taxes. I’m going to try simplifying that way and see how it works. 🙂

Hey, That sounds like filing I could actually do!! I’m gonna try it!

I tried that one year, but it got too full. LOL. Now, I make new file folders for every year and box them up at the end. Speaking of which…. I don’t think I did that yet.

Great tip on setting up a WEEKLY financial meeting with my husband. We have been putting off getting new life insurance and rolling over retirement plans.

On a side note, I noticed that you went for the Keira Knightly version of Pride and Prejudice. In my opinion, the Colin Firth Pride and Prejudice can never be topped! : ) Actually all of the BBC/Masterpiece Classic versions of the Jane Austen books are my favorite by far!

I do love the BBC version and own a very decrepit DVD of it. But, my husband prefers the KK version which means there’s a chance he might watch it with me. LOL. There was a method behind my madness. 😉

LOL! My tip for better bookkeeping is to follow Frugal Friday! 🙂

The other thing I did was to put it onto my regular Saturday list of things to do, along with cleaning the microwave, watering the plants, and ironing. Some weeks I don’t do it, but every week I have to make a conscious choice not to do it.

And, finally, the less I buy, the less receipts I have, right? Love that logic!

Love that, the less I buy, the less receipts I have! I should really give that a try!

HA! Glad to know FF is helpful.

I have a regular date every other Friday when my husband get paid to sit down and catch up the books. I don’t use a computer system I use all paper (very old school I know). My desire this year is to get more organized for the tax guy. I wrote down a list of what he needed this year now I just need to take a minute and type that list out and laminate it and then I think I am going to buy a binder and a few pocket folders to put in it and make up my own “taxes” binder, so next year all the work is done for me. (that is as long as I make sure I update it on the same Fridays I do our books)