Keep Track of Financial Stats and Monthly Costs

As an Amazon Associate I earn from qualifying purchases. For more details, please see our disclosure policy.

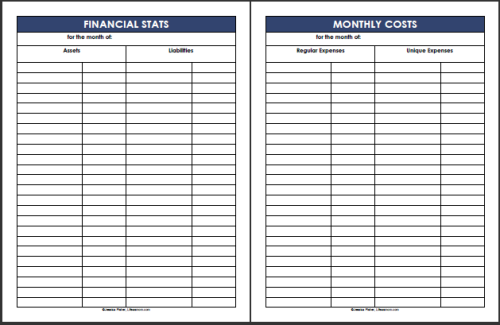

Keep track of Financial Stats and Monthly Costs with these helpful planning pages.

Want to save this post?

Enter your email below and get it sent straight to your inbox. Plus, I’ll send you time- and money-saving tips every week!

As you know, one of the biggest problems in money management is awareness. How many times have you heard someone say, “Well, I didn’t realize that we’d been spending so much”? In this age of plastic cards and paper checks, financial accounting is extremely important.

If you’re not playing the game with real greenbacks — and who pays their mortgage in dollar bills — it can be tricky to keep track of your financial status. Especially if you hate math.

One method that works for us is that each month after I’ve paid the bills and reconciled the accounts, I prepare a little summary to share with hubs. I’m the resident math geek so I’m pretty familiar with how our Quicken software works. But, I want to communicate things to my husband and partner in spending in a way that is straightforward and simple.

These Financial Stats and Monthly Costs Sheets help me do that. They serve as a communication tool for hubs and me. On the Financial Stats sheet, I list all our liabilities and assets, both liquid and long-term investments. This gives us both a clear cut snapshot of where we’re at.

On the Monthly Costs Sheet, I list all the expenses we pay for regularly as well as those that are unique to the month at hand.

Can your finance software do this? Probably. For me, I find that the act of writing each of these figures down helps me keep better mental track of our finances. That allows me to communicate better with my husband so that together, we can tell our money where to go.

With Christmas coming (Some of my shopping will be done on Black Friday or Cyber Monday) we are cutting back. The biggest is not eating out. It’s been so hard but I’ve come up with some new recipes which is a great feeling. The best way to eat in is planning. As long as I make a plan we’re good but as soon as I slip up, it’s a Chik fila drive thru time. We’ve been taking advantage of community Fall festivals instead of going places that cost any money at all, including gas and tolls. We are skipping professional Christmas photos this year and doing them ourselves with a help of a friend. We bought the kids outfits second hand and we’re doing face shots so I don’t have to buy shoes they will wear once.

Love the part about cropping out their feet! Classic!

Thank you! These worksheets arrived at the perfect time in my inbox. It’s been a haywire spending month, and it’s time to see why!

I like the idea of doing a monthly net worth sheet. That really puts things in perspective, I’m sure. Not that I plan to start it right away, but it’s on my list of things to think about doing.

That’s one thing I’ve learned from Crystal’s 21 Days to a Disciplined Life book: don’t make too many changes at once. Although Crystal’s book isn’t specifically about saving money, it encourages the mindset that makes frugal living possible, so I linked it up. Hope that’s OK.

And I linked up a post about pitting plums. Figuring out how to do it efficiently saved me a huge amount of plums that would otherwise have gone to feed our chickens, because I just didn’t have the energy to do things the slow way.

We did it every month when we had debts to pay. It’s great to see when you’re doing a debt snowball, but definitely better when you’re going on the positive side.