Keep a Record of Valuable Possessions

As an Amazon Associate I earn from qualifying purchases. For more details, please see our disclosure policy.

Keeping a written record of your valuable (ie replaceable) possessions can save you a lot of stress if a natural disaster, theft, or fire strikes your home.

Want to save this post?

Enter your email below and get it sent straight to your inbox. Plus, I'll send you time- and money-saving tips every week!

It’s common knowlege that we frugalites like to make sure we get a good deal on the things that we purchase. There’s also the understanding that we take care of what we have. No one wants to replace something unneccessarily. That’s why buying adequate homeowner or renter’s insurance is a wise way to protect your investment and personal belongings.

However, theft, fire, and natural disaster are events that could force any one of us into shopping for replacements.

Anyone who’s suffered property damage and the subsequent insurance claims knows what a hassle it is to create a list of valuable possessions that need to be replaced. The insurance company can’t replace your child’s baby book or your wedding pictures, but they will often work hard and spend money to replace the lawn furniture that got sucked up into a cyclone or the tv that was stolen.

However, if you don’t really know what you had or what it was worth, you may be on your own to replace it.

That’s why it’s good practice to keep track of what you own.

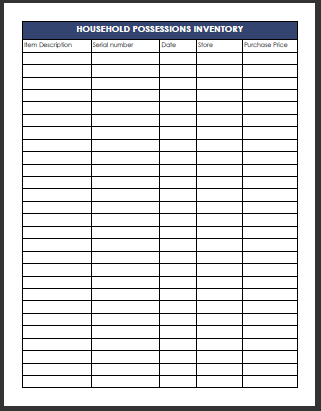

A quick way to document your possessions is to walk your home with a video camera and capture on film all those special items. However, if you ever do need to file a claim, you’ll still need a written record with a description of the item, serial number, date of purchase, place of purchase, and purchase price.

Download this free printable household possessions inventory. Now’s as good a time as any to start a written record of your valuable household possessions. Log in what you already possess and then as you acquire new items, write down the information right away. And yes, it might take some time to catch up on the bookkeeping.

It could save you a lot of hassle as well as replacement costs in the event of loss of property.

I spent a bit of time a couple years ago taking digital photos of everything, including our central unit, fire/smoke alert system, water heaters…everything I could think of, then loaded the pics onto a USB jump drive, including receipts and digital owner’s manuals. It went to the lockbox. A copy stays at home too for quick reference. Now, whenever we bring in a large or expensive item (new furniture, auto), the drive is quickly and simply updated.

A little over 3 years ago, we returned to an apartment to find most of our belongings gone (from electronics to toilet paper- they took it). Trust me, it’s hard enough without being uncertain of what was actually gone.

Back up your family photos (prior to age two we only have what pictures of our daughter were uploaded to Facebook). This was the worst loss.

Take the time to review your policy from time to time. Once we added up the value of my lost jewelry, we realized it exceeded the $1000 max and we would have needed an extra rider for their value. Since we didn’t check before the burglary, we were just out that money.

Wow, another story to learn from. What a bummer for you guys. Thanks for giving us such valuable input!

As someone who has had a minor loss (without an inventory) and is now an insurance agent, great post. Some additional suggestions:

1. Video/pictures allow for a quick snapshot of possessions. Documentation allows for detail of possessions. Some software like Microsoft Money have built in inventory tools. Here is also a great free online tool: http://www.knowyourstuff.org/iii/login.html

2. The inventory is only good if it is in a secure location. If you have a fire proof safe, great… but also consider a copy of the disc or document off-site in a safe deposit box, at a family members or your insurance agent.

3. Make sure that inventory includes vital information like a list of all bank/credit/accounts including account numbers and phone numbers of the companies. Other documents you’ll want record of include appraisals for collectibles/jewelry/etc. And don’t forget things like copies of shot records, birth certificates, etc.

4. If you have a loss, the quicker you start mitigating the damage the greater chance of rescue. Insurance companies can/will replace the furniture, etc. but they are limited in replacing one-of-a-kind possessions such as baby books… BUT quick action may be able to salvage those items via a restoration company. So just be quick about contacting and making sure they know which things you want handled first.

5. The usefulness of the inventory is only as good as it’s relevancy- so make a point to do annual updates (like at new year when you change your smoke alarm batteries, it’s a good time to revise inventory- especially to account for newly acquired holiday gift items, etc).

I am so sorry for your loss. Thank you for sharing your experience and giving us some hard-won advice.

I think this is a great idea. I’m not sure if my family has done this or not…but when my dad was still in the hospital, I photographed all of the stuff that was valuable to my dad, just in case something happened. This is a great idea for the home, too. Love and hugs from the ocean shores of California, Heather 🙂

Great reminder. Thanks for hosting.

This is a really good tip! I can see how it would be an essential thing to have in a fire or other disaster.

What a great idea! We really need to do this. I’m linking up a post about how to make your own pasta. It’s something I put off trying for years, but once I tried it discovered it’s way easier than I thought – and so tasty!

Keeping a list of our possessions is something I really need to do…so tedious though. I need a helper! 😉

I shared a recipe today for homemade wholewheat sesame crackers. They were a lot of fun to make and were very delicious. I never knew I could make my own crackers! Thanks for hosting and have a great weekend!

I love preparedness-themed frugality posts. Thanks for sharing your idea! I’m sharing two recipes today to help reduce the grocery budget.

1) Heirloom High-Rise Yeast Bread Recipe and Bread Making Tips:

http://www.lonehomeranger.com/2012/01/babcis-bread-cultivating-need-to-knead.html

2) Colcannon Irish Potatoes, Cabbage and Ham: http://www.lonehomeranger.com/2012/01/colcannon.html

This is a great idea and something I need to add to my to-do list.

thanks for the link up. I submitted: 5 Tips to Succeeding Your Goals.

http://www.familybalancesheet.org/2012/01/5-steps-to-succeeding-your-goals.html

Thanks for the reminder, Jessica. This is one of those tasks that I know I *should* do, but haven’t done anyway. We recently updated our wills (another task that’s so-not-fun in a similar way) so surely I can tackle this too!

Ewww… forget about updating… we don’t even have wills. Something more I don’t want to think about.

Oh dear, we did the video thing last year, including our thousands of books, but I have not prepared a list of valuables. Oh well, onto my list it goes!

I’ve been too busy being frugal to prepare a frugality post. LOL

Have a blessed weekend!

And as other comments have pointed out, make sure your video is in a safe spot. I forgot to mention that in the post.

I love this. Thanks for the inventory download, too! This week I posted on starting a natural food buying club. With a strong buying club, you can get organic, grass-fed and natural products at wholesale prices, instead of “Whole Paycheck” prices. 🙂

http://www.smallfootprintfamily.com/how-to-start-a-food-buying-club

What a fantastic idea! I wish I had seen this a week ago when we really started packing for our upcoming move. We could have kept a list while we were packing. I might have to do it soon anyways.

BTW Love your comment note “lets use our big girl words”

Great tip! My sister’s home was destroyed by fire last year. It was such a pain to go through and figure out what was missing/damaged/destroyed. Although it’s important to update it every now and then, too!

I’m definitely going to add this to my list of important projects to complete. One of the devastating tornados ripped through our area this past spring. Our home wasn’t touched, but we know many who lost so much… and insurance is a pain if you don’t know exactly what you lost.