How to Set a Budget

As an Amazon Associate I earn from qualifying purchases. For more details, please see our disclosure policy.

Ready to get your finances in order? If you don’t know how to create a budget. Today’s the day to learn how!

Want to save this post?

Enter your email below and get it sent straight to your inbox. Plus, I’ll send you time- and money-saving tips every week!

You hear the word budget all the time: budget-friendly this, budget-friendly that. I think people often mean: “being frugal” when they say “budget”. But that’s not the same as having a budget.

A budget is a recipe for how you will spend your money. It’s simply figuring out what you can spend on the different areas of your life without spending more than you have.

For years we struggled to create a workable budget since our income fluctuated with my husband being self-employed. We found out how to budget while self-employed people, tweaking other systems to fit our life and income.

As I confessed a few weeks ago, we’ve been a little loose with our budgeting of late. Aside from funding our France trip, we didn’t give any “extra money” (whatever we didn’t need for basic living expenses) a specific purpose. Instead, we let that be “fun money”. Now that we’re coming face to face with the reality of our rental property situation, we’re battening down the hatches. That means our budgeting is getting a little tighter.

“Been there, done that,” we say to each other, thankful that we’ve know how to live on less.

Here’s our process for creating a budget:

1. Determine your income.

For us, we’re focusing on the two regular checks we get each month: my husband’s paycheck and an inheritance he receives from his mom. That is our number to live on. Any other income that comes in is being saved, earmarked to pay the extra we will owe when we find a buyer for the rental house.

2. Figure out your baseline expenses.

As I paid the bills this month, I filled in each amount into this Monthly Costs Worksheet. Since I pay the bills and track our finances, this worksheet is a great tool to communicate things to my husband.

His first response: Our water bill is that high?

Communicating the amount of each bill in black and white is great; I know my comments aren’t falling on deaf ears and he can see it clearly.

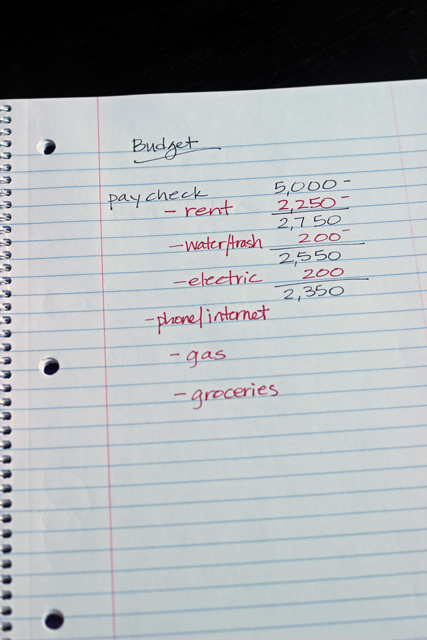

3. Subtract expenses from income.

Dave Ramsey uses this phrase a lot when coaching folks on budgeting: Give every dollar a name. It basically means that you’re going to determine what each dollar is for — before you spend it, if possible.

Take your income and start subtracting the expenses. If you do this line by line, then you really see how the money is “disappearing” as you spend it.

4. Make a plan for creative spending.

If you come up short or don’t feel enough comfort at the end of all that subtraction, you’re going to need to get creative. What can you do without this month? What can you cancel? Do you really need to have cable, lunches out, or that new pair of shoes?

Since we’re tightening our budget this month AND have school and doctor expenses that we don’t normally have, we have to be more creative in our spending — or not spending as the case may be. During our money meeting, we strategized about how to make it through the end of the month:

- using cash to track spending better

- using up gift cards

- not buying new stuff

- selling used school curriculum

- returning the shoes that I bought on a whim and haven’t worn

5. Revisit your budget frequently.

Every month you need to write a new budget. That was the thing I didn’t understand as a young bride. Every month is different. Your family has different needs, and you need to adjust accordingly.

When you’re just starting out — or getting back in the swing of things — I recommend revisiting the budget and retallying expenses on a weekly or bi-weekly basis. The more it’s in your face, the more diligent you’ll be.

You will get better at budgeting the more you do it. I promise.

Do you create a zero-based budget each month?

Why or why not? Do you have any tricks that help you?

I remember you used to have some free budgeting printables on your site—do you still have those? I looked around but couldnt find them.

Are you talking about these? http://lifeasmom.com/2012/10/keep-track-of-financial-stats-and-monthly-costs.html

I have a spreadsheet with a tab for every month. We track what comes in and what goes out every month down to the penny! We are paying down a large student loan and everything extra every month goes directly to that loan. I will make 2-3 payments a month on it as soon as extra cash appears in our budget. I know we are lucky to have the funds to pay it down, but sometimes I hate watching our money that closely every month. Once the loan is gone, we are going to have a couple of months of “fun money” and not watching the budget then tighten down again and start attacking our mortgage!

Keep on keeping on! You can do it!

Check out YNAB (You Need A Budget). It is a budgeting program that has completely changed my financial life for the better. It does all the things you talked about above in a practical user-friendly way. I use it, and 3 of my adult children also use it. I use it strictly on my home computer, but my kids all also access it from their smart phones, enabling them to enter transactions literally at the cash register as they check out.

I completely agree Mary. My husband and I are die-hard YNAB users. It completely changed our financial life as well. The $60 investments pays for itself easily. We love the easy accessibility on our smart phones, the flexibility, and the user friendliness.

Thanks for the tip. Is it a yearly fee?

Sorry, I just came across your question – it got lost in my email. YNAB costs $60, one-time-only fee, then it is yours forever.

YNAB has basically saved my marriage. No lie. We finally found something we could both understand and it made sense with our commission based income. We have to live on last mo THS income because we have no idea what we will make this month. It just finally made sense instead of trying to predict the future!!