Living on One Income and Living Well

As an Amazon Associate I earn from qualifying purchases. For more details, please see our disclosure policy.

Living on one income is not as easy as it was in the last century. It requires hard work and determination — and some of these strategies.

Want to save this post?

Enter your email below and get it sent straight to your inbox. Plus, I'll send you time- and money-saving tips every week!

Fifty years ago it was commonplace for just one parent (usually dad) to work. One income was sufficient to pay the family’s bill. Today, there might be a number of reasons why a family would be living on one income.

- Mom or Dad might be laid off from work or unable to find a job.

- Mom or Dad might need to leave the workplace for health reasons.

- Mom or Dad might decide to stay home to care for the children or an aging parent.

- One parent might be in school or other vocational training.

- There might only be one parent in the family. Single parenting is a tough job, not to mention it’s difficult economically.

- You don’t want to rely on two incomes in case of health or economy-related issues arise in the future.

While our family currently earns two incomes, we try as best we can to make it living on one income, mainly because of reason #6. If one of us became unable to work or the economy took a major dive (again), we’d like to be living under our means to be able to weather the storm.

I never expected that our family would be as hard pressed as we were in 2007. We’d been living beyond our means and got ourselves in a mess of trouble. Thanks be to God, we got out of debt.

Getting out of debt and living on one income have been some of the best things we’ve ever done.

Living on One Income

Whether you want to or have to, living on one income doesn’t have to be heartbreaking. Here are some of the things that we’ve learned the hard way to make living on one income possible:

Monthly Accounting Forms

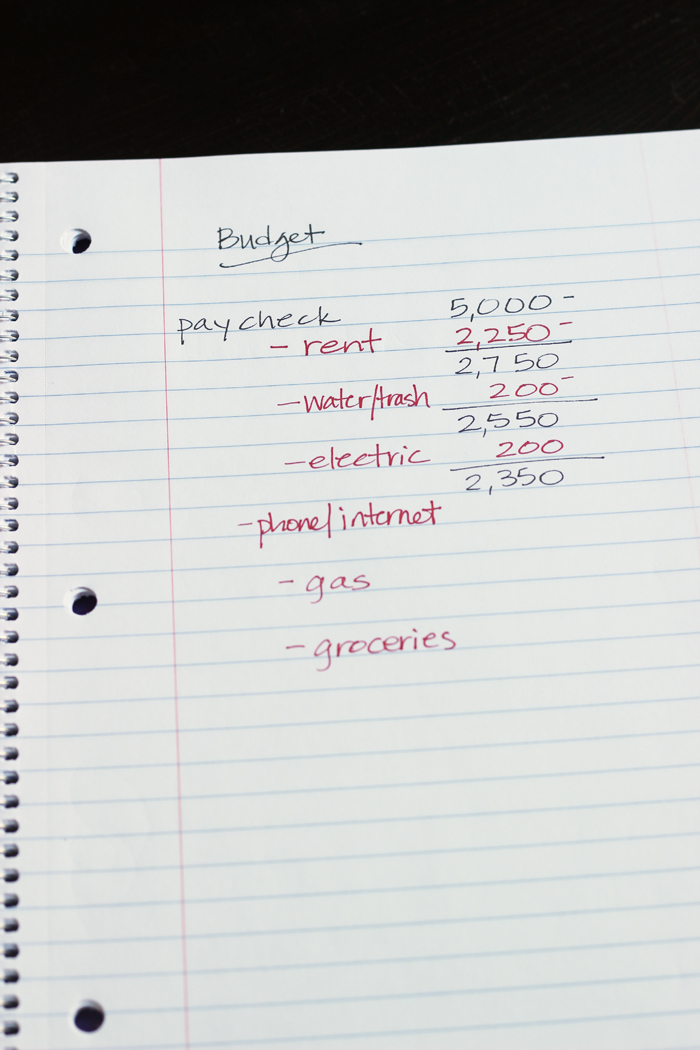

1. Create a budget based on one income.

Create a zero-based budget in which every dollar has a name. Determine all your required expenses and list those. Subtract that amount from your income. Anything left should go toward savings (like an emergency fund) and discretionary spending.

If there’s nothing left, then you need to figure out how to increase your income or reduce your spending.

2. Build an emergency fund.

An emergency fund is a set amount of money that you don’t touch unless you really have an emergency. Dave Ramsey sets a starter emergency fund at $1000. Folks disagree on what your longterm emergency fund should be. We have nine months’ to a year’s worth of expenses socked away in an account we don’t touch. It’s liquid in case we need it, but we don’t touch it. Experts’ recommendations range from three months to a year.

You will have to decide what you need based on your particular circumstances. If you own your home outright and have no debts, you might not need as much as someone with higher monthly expenses. Likewise if you know you could find a new job quickly.

3. Reduce expenses wherever you can.

If you don’t have an unlimited budget — we don’t — then keeping a handle on expenses is almost a full-time job. Costs can creep up when you’re not looking. A couple extra trips can add up. (I’m looking at you, Target.)

As Mad-Eye Moody says, your spending needs “constant vigilance”. You can’t turn a blind eye to your bank account. Sodas might become a special occasion treat — and cause for a picture! — and that’s okay!

Remember there are lots of little ways in which you can cut back that will ease the strain on your wallet:

- Gifts

- Vacation

- Groceries

- Birthdays

- Entertainment

- Baby Stuff

- Cars and Gas

- Clothing

- Home Improvements

- Household Expenses

- Christmas

- School Stuff

4. Enjoy simple pleasures.

You don’t need a ton of money to live a good life. You might need a little creativity, though.

Homebaked always tastes better than store bought — and it’s cheaper, too. Books and movies are free at the library. The park is just around the corner. Second-hand bikes sell for a song. Pinterest is chock full of ways that you can live frugally.

You don’t need to be down in the dumps if your income isn’t soaring. Most of the world doesn’t have all the resources that we do. Chin up, buttercup, you can rock this.

What do YOU think?

What has worked for you living on one income? Let us know in the comments section.

Originally published August 27, 2015.

Any advice for a family with decent but fluctuating income? My husband and I own a successfully landscaping business but our income varies greatly from month to month and nearly stops during winter months. We’ve been “winging” it without a budget for a long time but have racked up nearly 30k in debt between credit cards and personal loans.

How do you manage finances properly when you have no idea what your income will be month to month?

Been there! One of us has been self-employed our entire marriage. This is what we finally figured out: http://lifeasmom.com/2011/02/paying-off-debt-when-youre-self-employed-frugal-friday.html It works to pay down debt, as well as just build savings and manage well.

I live on disability and it isn’t much I also get some child support for my grand daughter but that can’t be counted on every month-by the time I pay my mortgage which isn’t a lot I bought a fixer upper for cheap, utilities, car insurance and 1 credit card I have nothing left thank God I have a mother who makes good money and helps me out when I need it. I have NO money to put in a emergency fund or into a savings for that matter. I love this article and hope it helps people good advice

How wonderful that you are such an invested grandmother! Good job!

We have chosen (for reasons other than financial) not to have a TV. If we want to watch a movie we use our laptop. Whenever we’re tempted to get a TV we think of our original reasons but also the financial. If you have a TV you pay for the TV, the entertainment center, the movies, the cable/dish/whatever, the game console, the games…. it adds up to a lot of money. Since the laptop isn’t quite as much “fun” as a TV is we spend a lot less on new movies or rentals (because we watch only a little.) And we don’t get new video games. We have friends with a Wii so if we want to play we spend time with them. We’ve been married 5 1/2 years and have a 2 1/2 year old son and except for the occasional wish for a Wii we don’t miss it and our pockets (and hearts) have been fuller.

Sounds like a great strategy that fits your family well. Good job!

I love all of your suggestions–our family employs them, too. One of our best ways to keep our one income budget in check is to always eat at home. Eating out is not just expensive, it is often more of a hassle than it is worth. Most of the restaurants we can reasonably afford with two adults and three kids serve food that we can replicate ourselves for a fraction of the cost. Besides, our family likes cooking, so eating “in” is often more of a treat than eating “out.”

Eating in definitely saves money. For our family, with few outside hobbies, restaurants are a little splurge we allow ourselves once in awhile. Food is our family hobby, actually. Plus, I think having a little mad money helps us stay the course.

I love your positive attitude! We are currently working on getting out of debt. I totally know that it is worth it, but there are certainly days when we want to live like everyone else. It is so counter-cultural to live beneath your means and to buy things without debt, but we’re eagerly waiting for the day when we have zero debt. Thanks for your encouragement. It’s always inspiring to see how other families handle their finances.

It is worth it! Keep fighting the good fight!

I love the YNAB rules but am too cheap to buy it so I made my own Excel spreadsheet to do the same thing. :). Plus I like to budget by paycheck not by month. Also if you take their classes they give out a free copy in each class.

We have yet to take the plunge into that. I know lots of people say they love it, but I just can’t commit.

Since marriage, we’ve lived on one income (sometimes with a little part time work giving a bit more to the budget.) It really can be about perspective. Some people wondered how we could do it, but really it can just mean things like fewer dinners out or movies in the theater, and making conscious choices about spending. We’ve never felt deprived, and have had some wonderful experiences. It helps that we all love the outdoors- free entertainment and your very own gym right there- when the weather cooperates!

I think attitude is so key!

Thanks for this! I’m a single mom of three under 10 years old who manages to work part-time and have no debt and decent savings. I live cheap! I use mint – a free app that tracks all of my spending and saving. I also automate my savings. On payday, transfers automatically go into my savings account, retirement, and kid’s 529’s (and charitable giving as well.) I never miss the savings, but if I waited to save until I thought I could, there would never be anything left! I use this savings to pay for emergencies and larger expenses throughout the year. I grocery shop only a few times a month and meal plan (I freeze bread and switch to powdered milk and frozen vegetables and canned fruit near the end of the month so we can make it until the next payday and shopping trip.) I drive an older vehicle with good gas mileage which I intend to run into the ground. Lastly, I have a good paying job as an accountant (my hourly income has doubled in the last three years) which gives me flexibility and room for growth. Working only while my older kids are in school allows me to save on childcare. But did I spend a ton going back to school to train for this field? No, I went to a community college, which offers the exact same classes required for a CPA in my state as a graduate school. My entire degree was less than $3000. Living frugally is my passion, and I’m so happy to have your site with such great tips and advice! Thanks again!

Great job! You’re doing great!

When my husband lost his job several years ago we had to make some adjustments. In addition, to reducing the grocery budget to the USDA thrifty plan these strategies have also helped. First, don’t pay others to do what you can do for yourself – wash the car, mow the lawn, clean the house, make minor home repairs, change the oil in the car, etc. Second, eliminate most magazines and newspapers – we continue to subscribe to the daily newspaper. Third, teach your children the value of a dollar. Our daughters are 10 and 13 and work for pocket money during the summer. They each earned over $200 this summer, which was enough to pay for their own back-to-school clothes and shoes. We never planned to live on one income, but we are making it work.

Sounds like your family has a great system going. Has your husband found work again?

No, we continue to live on one income. We decided between the expense reductions (no after school childcare, gasoline driving to and from work, work clothes, etc.) and the many non-monetary benefits to having one stay at home parent that he would quit looking for work until the kids were older.

Our kids particularly enjoy the following benefits of having a stay at home dad:

1. They get to come home right after school and start on their homework.

2. They get to participate in a number of after school activities since dad is available to drive them to and from.

3. Our home is the one the kids and their friends are at most of the time. Their friend’s parents are comfortable with them at our house after school knowing there is an adult in attendance. Additionally, while the kids would never say so, it’s clear they like having an adult around.

4. Taking road trips with dad in the summer. I am not big on long car trips, but my husband loves to drive. So a couple times a summer he will load them up in the car for a week or so and take road trips to visit family around the country.

5. Throughout the year the kids make money walking dogs, keeping an eye on neighbor’s homes while they are out of town, babysitting, etc. Many of these opportunities would have to be turned down without dad available and willing to drive them to the jobs. Last month they each made $110 walking dogs, which was more than enough money to buy a new dress and a pair of shoes.

Sounds like a win-win for everyone! Love it when that happens!

Great post – good things to think about

We live on one income because, frankly, I have no interest in working. I did so while my husband was in medical/grad school, but now that he’s in residency (and getting a paycheck), I get to stay home with my animals, take care of the house, and not have that mental stress of working full time and never seeing him. I also have time to be an assistant debate coach now, which I never would have been able to do while working full time. Debate season starts tomorrow!

I have vanilla coffee in the coffee pot cooling down for iced coffee tomorrow and two pasta bakes (pasta, caramelized onions, peas, reduced mushrooms, roasted red bell peppers, sun dried tomatoes, artichokes, sauce, cheese – I went all out this time) in the oven for freezer meals. WOOT!

I love it that you’re finding what works best for the two of you!

Hi Molly! Those pasta dishes sound soooo good! Do you mind sharing he recipe with all of us? I like the idea of your vanilla coffee too! Thank you in advance and good luck on your debate team!

Oh gosh I never saw this! So here’s an update…. a long time later. 🙂

What I’ve been doing lately for pasta bake:

1 box of pasta (penne and rotini work well), partially cooked – maybe 7 minutes instead of 10

sundried tomatoes – 1 bag – I use trader joe’s – chopped

onions – LOTS – cooked down in oil until caramelized

mushrooms – I buy mushrooms on sale and bake them in a dish with some butter and salt until they reduce in volume by about half – and then I freeze them, so I use about 2 cups of the reduced-in-volume mushrooms

roasted red bell peppers – 1 jar – again, trader joe’s – chopped

spinach – 2 boxes of frozen spinach, thawed and drained (drained is key!)

some sort of fake meat – trader joe’s soysage or the field roast sausages – chopped

pasta sauce – homemade with red wine is my favorite, but we don’t always have that

ricotta – 1 tub

italian seasoning – some, lots, I don’t measure (Can you tell measuring is not my forte?)

shredded mozzarella – half a bag

Mix everything except the shredded mozzarella in a giant bowl – like, way bigger than you think you need. I always use too small a bowl and make a mess. Put the well-mixed mixture in a 9×13 baking pan (might need 2 if you go hog wild on the amounts) and bake at 350 for maybe 20 minutes, or until the cheese melts.

I hope that helps! It looks like in 2015 I was using artichoke hearts and peas, but turned out my husband didn’t like those additions as much. Enjoy!

Hi Molly! Thank you so much for the pasta and iced coffee recipe! Sounds good- will make it this week! True hallmark of a great cook is eyeing the ingredients and not measuring lol- I do that too! We just know!

And I think the vanilla coffee was an Aldi special buy. 🙂 I made a giant pot in the coffeemaker, turned that off, let it cool a bit, put it in mason jars and stuck it in the fridge. I still do that in the summer because hot coffee makes me sweat!

We also have a year’s worth of expenses in our emergency fund. Many say that is too much but that is what we need to have to feel secure.

Peace of mind is definitely worth something.

I love all your suggestions. One other thing that really helps is to surround yourself with equally frugal-minded people. Having friends who are happy to picnic rather than go to a fancy restaurant makes being frugal, well, a non issue. Gatherings are about fun and people, not about worrying about money. Also, being around others in the same situation gives a sense of community and fun about saving money. I have a solid group who share deals and ways to do things cheaper. Here are some frugal friend things that have happened recently — I play tennis each week with a friend. We use the public free courts so have an hour+ of exercise for zero dollars — during the summer, our sons also play tennis together while we play. I walk my dog regularly with another friend – we catch up on our lives and get exercise for both us and our dogs. One friend helped me “crisis clean” before house guests came. I will help her paint her bathroom in exchange. A neighbor passed on a perfectly nice but slightly rusty bistro set to me. I will gift it to another friend who has been looking for just that thing. I traded some plants from my garden (phlox) for a different color from another local gardener. I shared a few cucumbers from my garden with another neighbor and let her little boy pick a tiny pumpkin from my vine. Another neighbor took my son swimming with her son (her mom has a pool). I feel very lucky to be living in a community with so many like-minded frugal families.

Awesome! I love these stories!

Excellent post! You might check out the budgeting program YNAB (You Need A Budget). It has been life-changing for me and my family. They offer a 34-day free trial, and then the program costs $60 – a one-time fee. You can find a link by Googling it. They also offer it free for students as long as they are in school. The budgeting principles you talk about describe it perfectly. It lives on a desktop or laptop computer, and links to your smart phone or tablet so transactions can be entered in real time right at the checkout register. I am not affiliated with YNAB in any way other than a very satisfied user.

thanks for that tip! that’s my problem – not updating my register until a few days later

Thanks for the tip. We have talked about it, but I am still not sold. I researched it at the beginning of the year, but never took the plunge. Someday maybe. So glad it’s working for you guys!

The mint app dot he mint app does the same thing and it’s FREE!